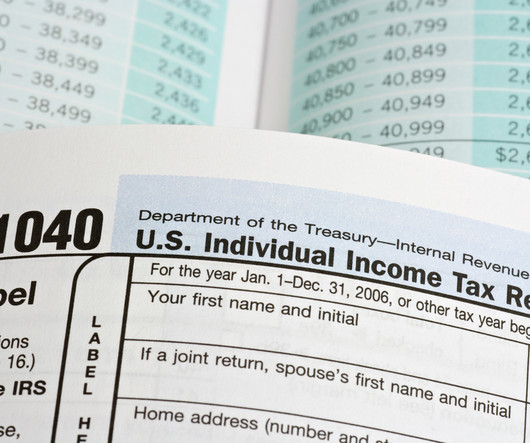

1041 Trust Tax Preparation and the Need for Professional Tax Help

MyIRSRelief

OCTOBER 30, 2023

The fiduciary of an estate or trust is responsible for filing Form 1041, which is due on April 15th each year (unless an extension is filed). Trust tax preparation can be a challenging task, even for experienced tax preparers. Third, a tax preparer can help you to avoid costly tax penalties and errors.

Let's personalize your content