CPA Versus Tax Preparer: What’s the Difference?

Summit CPA

MARCH 7, 2024

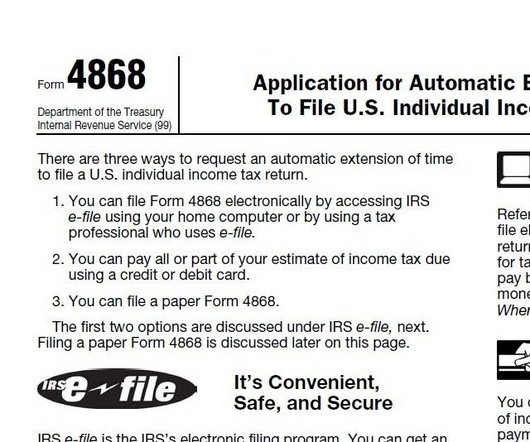

The requirements are minimal: In order to obtain a PTIN, the applicant must verify with the IRS that they are in compliance with their own taxes and pay a small yearly fee ($19.74 While the IRS encourages non-credentialed tax preparers to increase their knowledge through continuing education, doing so is optional.

Let's personalize your content