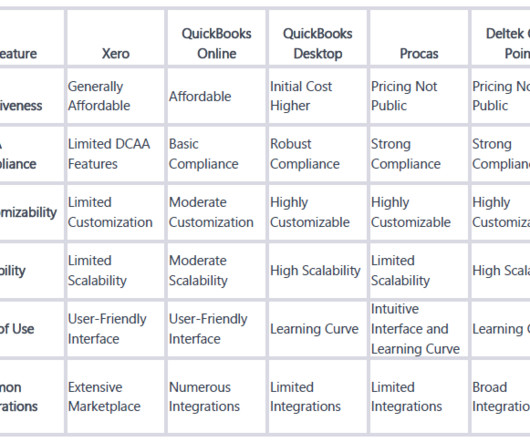

Choosing the Right Accounting Software

SMBAccountant

JANUARY 5, 2024

Beyond the mere transition in dates, New Year's marks a universal opportunity for change. It can serve as a catalyst for reflection, inspiring individuals to set resolutions, for themselves and their businesses. The beginning of a new year also means a fresh start for your Income Statement; which is why now is the perfect time to review your accounting software needs.

Let's personalize your content