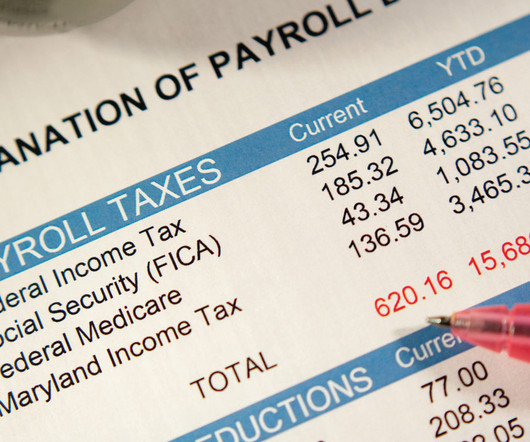

Colorado: Fee or tax?

TaxConnex

SEPTEMBER 13, 2022

Remote retail sales just got rockier in Colorado, which has begun imposing a 27-cent fee on every retail delivery made by motor vehicle to a destination in the state. The fee must only be charged once per order, even if the order will be split into multiple deliveries, according to the Colorado Department of Revenue’s guide.

Let's personalize your content