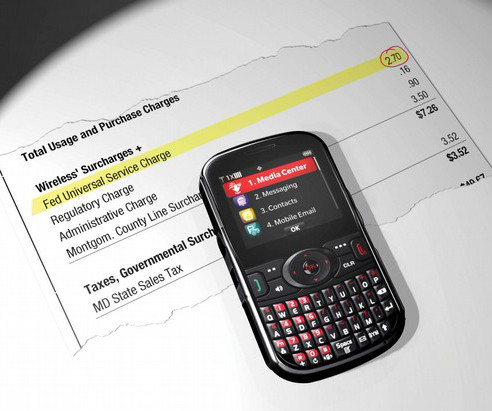

Worried About an IRS Audit? Prepare in Advance

RogerRossmeisl

NOVEMBER 13, 2022

IRS audit rates are historically low, according to a recent Government Accountability Office (GAO) report, but that’s little consolation if your return is among those selected to be examined. From tax years 2010 to 2019, audit rates of individual tax returns decreased for all income levels, according to the GAO.

Let's personalize your content