IRS Offers Resources and Advice During National Small Business Week

CPA Practice

APRIL 28, 2024

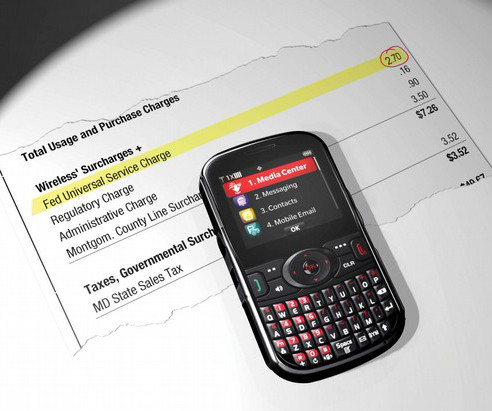

The Internal Revenue Service is offering tax-related information to entrepreneurs in anticipation of the upcoming kick-off of National Small Business Week. The U.S. Small Business Administration coordinates the annual event, helping entrepreneurs with resources, benefits and other important business startup information that small business owners can use to launch their enterprises.

Let's personalize your content