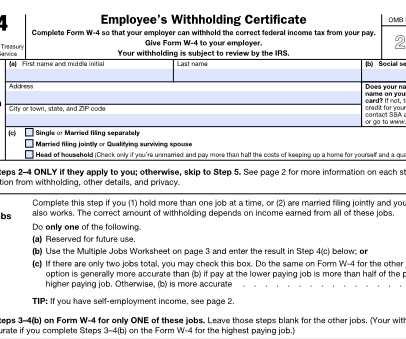

Payroll Tax Resolution – How to Resolve Payroll 941/940 Tax Problems

MyIRSRelief

AUGUST 10, 2020

Payroll tax resolution issues are amongst the most common reasons for the IRS pursuing Los Angeles or other cities, business taxpayers, or individuals whom they deem should be responsible taxpayers, which is why it’s important to ensure that you resolve any payroll 941/940 tax problems sooner, rather than later, should they arise.

Let's personalize your content