PCAOB finds auditor evaluation deficiencies

Accounting Today

APRIL 19, 2024

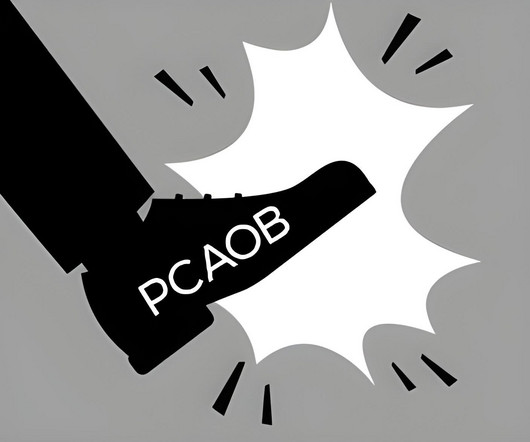

Seventeen percent of comment forms in 2021 and 2022 contained auditor evaluation deficiencies, according to the PCAOB.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Accounting Today

APRIL 19, 2024

Seventeen percent of comment forms in 2021 and 2022 contained auditor evaluation deficiencies, according to the PCAOB.

Accounting Today

NOVEMBER 14, 2023

from 2021 to 2022, and more auditors are using data analytics in their audits, according to a new report. Average audit fees increased by 4.6%

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The New Way CPAs are Delivering Value: Aligning Automation with Client Success

Profit in the Details: Rethinking Spend for Monumental Impact

Fall In Love With the Month-End Close

Building a Business Case for Finance Automation

Navigating Payroll Compliance: Future-Proofing Payroll in an Evolving Regulatory Landscape

TaxConnex

APRIL 28, 2022

In years past, auditors could show up at your door asking to look at your records. Many audits are conducted remotely, and an auditor never visits your office. Auditors can tap different data sources to select audits more accurately based on the level of risk, and to use new tools to automate the repetitive tasks of an audit.

The New Way CPAs are Delivering Value: Aligning Automation with Client Success

Profit in the Details: Rethinking Spend for Monumental Impact

Fall In Love With the Month-End Close

Building a Business Case for Finance Automation

Navigating Payroll Compliance: Future-Proofing Payroll in an Evolving Regulatory Landscape

Going Concern

DECEMBER 10, 2022

The PCAOB should be dropping the first batch of 2021 inspection reports soon, and as an appetizer before the main course, the audit cops issued a report Dec. Most of the audits that we inspected in 2021 involved the 2020 financial information of public companies with fiscal years ending in December 2020. inspection observations).

TaxConnex

MAY 18, 2021

As we entered 2021, many industry experts believed that state? An audit of your customer – A customer undergoing its own sales tax audit may produce one of your invoices , resulting in the auditor questioning why you are not charging sales tax and potentially leading to an inquiry or nexus questionnaire being sent to your company.

TaxConnex

FEBRUARY 27, 2024

million accountants and auditors in the U.S. More than 300,000 accountants quit their jobs between 2019 and 2021, data show.” Are they experienced with auditors? “There were about 1.65 in 2022, up 1.3% from the previous year but down 2.6% from 2020 and down 15.9% What’s their customer service?

Going Concern

JANUARY 13, 2023

Of the six 2021 PCAOB inspection reports released before the holidays, we ’ve so far taken a look at five: PwC , Deloitte , EY, KPMG , and BDO USA. Seven of the 31 audits we reviewed in 2021 are included in Part I.A The last of the bunch belongs to Grant Thornton. We didn’t save the best for last, but it’s not that bad either.

Going Concern

DECEMBER 21, 2023

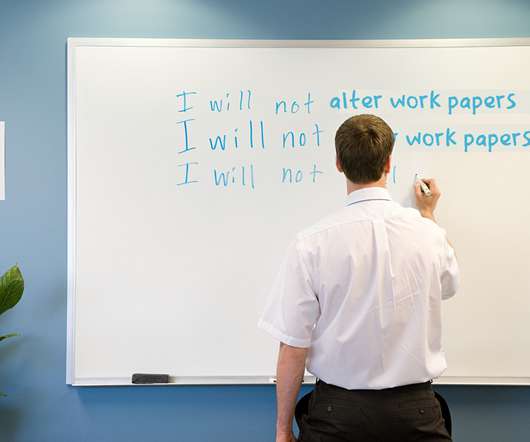

Assuming no one but select audit partners actually read this crap, let’s take a look at how auditors should expect increased vigilance in 2024 so everyone can be better informed and stock up on KY. You’ve been warned, auditors. ” And God forbid you people not file a Form 3 in a timely manner or YOU WILL BE PUNISHED.

Going Concern

DECEMBER 30, 2022

Next up on the PCAOB ’s hit list is EY, whose 2021 inspection report was released on Dec. Twelve of the 56 audits we reviewed in 2021 are included in Part I.A Long-lived assets: The deficiencies in 2021 related to testing controls over the valuation of long-lived assets and the evaluation of misstatements related to long-lived assets.

Going Concern

MARCH 24, 2023

Auditors have done so too. This has become a problem for German real estate company Adler Group as it battles waning investor sentiment in the wake of a short seller attack in October 2021. Auditors Are Demanding Concessions in Split [ Wall Street Journal ] Ernst & Young’s renegade U.S. appeared first on Going Concern.

Going Concern

APRIL 7, 2023

Auditors who think robust regulation of their sector is disproportionate deserve “the world’s smallest violin”, the head of the UK accounting watchdog has said. Thompson said that if auditors did not want to face such pressure, they should do a better job, these people added. Yeah, that checks out. million (USD$58.7

Going Concern

OCTOBER 14, 2022

KPMG UK has promoted a historically modest 25 new equity partners this year as it makes greater use of the salaried partner badge which it introduced in 2021. A longer, meatier report from auditors was introduced over the past decade in both the US and Europe. The Auditor’s Responsibility for Fraud Detection [ SEC ].

Going Concern

JANUARY 6, 2023

In the 2021 inspection of BDO USA, LLP, the PCAOB assessed the firm’s compliance with laws, rules, and professional standards applicable to the audits of public companies. Sixteen of the 30 audits we reviewed in 2021 are included in Part I.A Fat Joe’s favorite audit firm once again had a spectacularly horrible PCAOB inspection report.

Going Concern

APRIL 7, 2023

Big Four Auditors and Consultants Need Liability—And a Divorce [ Bloomberg Tax ] Part of the problem is the revolving door of personnel between the major accounting firms and the banks they purport to audit. Last month, audit firm BDO issued a so-called qualified opinion for Revolut’s 2021 accounts.

TaxConnex

DECEMBER 21, 2021

Hiring is on the minds of many executives as we end 2021. Are they experienced with auditors? Teams are leaner than ever as existing employees quit, and new ones are harder to find. What should you know, what should you look for, and what are your options? Are they based domestically or offshore?

Going Concern

JULY 31, 2023

The PCAOB’s new rules would widen auditors’ responsibility to scrutinise whether a company is complying with laws and regulations, and to communicate more of their concerns to a company’s board of directors. The post Monday Morning Accounting News Brief: ‘Auditors Are Not Lawyers’; Big 4 Break Up?

Going Concern

JUNE 29, 2022

The hardworking human beings at Audit Analytics have released their analysis of initial public offering trends and IPO auditor market share for the first quarter of this year , a period in which the number of companies going public was minuscule compared to Q1 of 2021. of all IPOs in 2021 and nearly 83% of SPACs.

Going Concern

JULY 2, 2024

BDO racked up deficiencies for more than half of the audits inspected by the PCAOB for its 2021 inspection report. For the second straight inspection cycle, the PCAOB found significant mistakes in more BDO audits than ones without (16 out of 30 in 2021 and 13 out of 24 in 2020 ). As a result, BDO followed its 54.2% There’s more!

Going Concern

FEBRUARY 2, 2023

But that three-year streak of perfection came to an end, according to its recently released 2021 PCAOB inspection report. If you include the last time Cohen & Company auditors screwed up an audit, which was in 2017, that’s two mistakes in the last 43 audits inspected, for a deficiency rate of 4.6%.

Going Concern

FEBRUARY 3, 2023

From the report: The independent auditor for Adani Enterprises and Adani Total Gas is a tiny firm called Shah Dhandharia. 435 in 2021) in monthly office rent. Hindenburg backs up these claims with copies of the auditors’ IDs, Adani Group said publishing this information showed a “brazen disregard of personal privacy and safety.”

PYMNTS

JANUARY 10, 2019

Auditors of the European Union said Thursday (Jan. According to the report, auditors said that the EU has only been able to get back about 15 percent of the misused funds. What’s more, the auditors said fraud was likely underreported because the mechanism to share information between EU states wasn’t that effective.

CPA Practice

SEPTEMBER 17, 2024

During its inspections of public accounting firms’ audits of issuers from 2021 to 2023, the Public Company Accounting Oversight Board (PCAOB) saw a year-over-year increase in the number of comment forms related to auditor independence problems, the audit regulator said in a staff report released on Sept.

Going Concern

NOVEMBER 16, 2023

The FERF 2022 Public Company Audit Fee Study Report examines audit fees companies paid to external auditors for auditing and related services for the period between June 2022 and May 2023. percent from 2021 to 2022 Of more than 6,200 clients, the average audit fee works out to $2.4 Here’s what you need to know. million ( sauce ).

Going Concern

OCTOBER 19, 2022

The PCAOB has made it painfully clear that they are done pussyfooting around and sick of auditors not doing their jobs. Chair Erica Williams said in September the Board plans to use every tool at their disposal to bring the hammer down on naughty auditors and it seems that’s exactly what they’re doing.

CPA Practice

NOVEMBER 11, 2024

First, on multiple occasions, the accounting firm failed to timely report the participants in its issuer audits on PCAOB Form AP, in violation of PCAOB Rule 3211, Auditor Reporting of Certain Audit Participants.

Going Concern

JANUARY 9, 2023

A PCAOB inspections leader offers his insight to auditors at a conference: “The role of the financial statement auditor and the auditing profession continues to be a noble endeavor that has never been more needed and vital to our economic stability and the well-being of our capital markets,” said George Botic, CPA.

ThomsonReuters

JANUARY 3, 2023

Too many of today’s auditors are stressed and overworked. Therefore, firms need to ensure that auditors can access the tools they need and achieve the greater work-life balance they desire should they wish to retain top talent. . Auditors are no exception. What challenges do auditors face today?

CPA Practice

AUGUST 19, 2024

According to a new report from The Brattle Group, total Public Company Accounting Oversight Board (PCAOB) and US Securities and Exchange Commission (SEC) enforcement activity against auditors in the first half of 2024 is significantly outpacing the number of enforcement actions brought by the regulators in recent years.

Going Concern

JANUARY 4, 2023

The last of the 2021 Big 4 PCAOB inspection reports belongs to KPMG, which has had the highest audit deficiency rate of the four firms for six out of the previous seven years —the lone exception being 2019. Fourteen of the 54 audits we reviewed in 2021 are included in Part I.A

ThomsonReuters

DECEMBER 6, 2022

Today, ESG is resulting in significant opportunities for auditors, fueled by the widening range of stakeholders calling for ESG prioritization, an influx of laws and regulations pertaining to ESG, and a rise in ESG investment products. What is the role of the auditor in ESG reporting? The future of ESG accounting.

CPA Practice

SEPTEMBER 20, 2023

However, the nearly 4% increase in audit fees over FY 2021 was less than the year-over-year inflation rate in 2022 of 6.5% Executives and researchers cite multiyear contracts that have locked auditors into lower fees and pushback from clients at a time when companies are also wrestling with rising costs. in the U.S.,

Going Concern

JUNE 29, 2023

Reports Financial Times : The firm’s junior auditors were told on a webcast last week that the pay band for one cohort would be frozen while others would increase by 3 or 6 per cent, resulting in real-terms pay cuts, firm insiders told the Financial Times. billion ($2.2 billion ($2.2

CPA Practice

APRIL 7, 2023

In 2021, there was a 17 percent drop in employed accountants and auditors from a 2019 peak, according to a Bloomberg Tax analysis. Auditors can do their work in as little as two or three hours, as opposed to the days or weeks they would typically spend auditing accounting by sifting through file cabinets and chasing paper.

Going Concern

FEBRUARY 21, 2024

Said the PCAOB press release : From January 2020 through December 2021, WithumSmith+Brown, PC accepted a substantial number of special purpose acquisition company (SPAC) audit clients, resulting in a dramatic increase in its issuer audit practice and putting a significant strain on its quality control system.

CPA Practice

MAY 15, 2023

However, the $625 million in total monetary settlements was down more than 60% from FY 2021, and 44% lower than the average total monetary settlements between FY 2017 and FY 2021, according to Cornerstone Research. The civil penalties imposed in FY 2022 represented 67% of total monetary settlements, up from 56% in FY 2021.

Going Concern

JULY 26, 2023

Williams does not have severe audit firm-induced trichotillomania (to our knowledge) because here she is again warning auditors that the PCAOB is tired of them being so terrible at auditing. That is up 6 percentage points from 2021, which was 5 points higher than the deficiency rate in 2020. and non-U.S.

Going Concern

MAY 5, 2022

On top of the overall pipeline issue, we’ve heard grumblings of auditor shortages for years. The PCAOB is watching , too, concerned about the obvious audit quality problem that arises when your already overworked auditors are now doing the work of 10 people instead of a more modest three to four. Photo by Kate Trifo.

CPA Practice

APRIL 3, 2023

In 2021, there was a 17 percent drop in employed accountants and auditors from a 2019 peak, according to a Bloomberg Tax analysis. Auditors can do their work in as little as two or three hours, as opposed to the days or weeks they would typically spend auditing accounting by sifting through file cabinets and chasing paper.

Going Concern

NOVEMBER 30, 2022

The report makes clear that complaints are up compared to 2021 [ 2021 report ] because people are back in the office together doing complaint-worthy things which they weren’t doing as much of during fiscal 21: We have seen an increase in misconduct and disciplinary complaints in FY22. We’ll take their word on that.

ThomsonReuters

APRIL 30, 2024

Auditors rely on data review to ensure the reliability and integrity of financial statements. Auditors must ensure that financial statements are free from material misstatements and that all relevant information is included. It helps auditors identify errors, irregularities, and potential fraud.

Going Concern

DECEMBER 13, 2022

And this is after the PCAOB has warned auditors repeatedly that they are not playing around and are liberally handing out demerits for naughty behavior. Mom is getting ready to turn this car around if auditors don’t get it together. The causes likely vary from firm to firm. finding cannot be explained away by the pandemic.

CPA Practice

AUGUST 15, 2023

Snodgrass —failed to obtain audit committee pre-approval in connection with providing audit and/or non-audit services to issuer audit clients, in violation of PCAOB Rule 3520, Auditor Independence , and for two of the three firms (BPM and Plante Moran) PCAOB Rule 3524, Audit Committee Pre-Approval of Certain Tax Services.

ThomsonReuters

JUNE 15, 2023

Auditors are having to expand the scope of their work as ESG is increasingly under the scrutiny of stakeholders and investors. Firms must either upskill their auditors or invest in new talent with the education and qualifications around ESG to ensure the proper engagements occur. Here is a brief summary of the top five: 1.

CPA Practice

JUNE 6, 2024

For the study, which appears in the American Accounting Association’s Journal of Forensic Accounting Research , researchers looked at data from 10,992 companies between the years of 2011 and 2021. One takeaway message here is that cuts to IRS budgets seem to have the unintended consequence of encouraging aggressive tax behavior.”

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content