IRS 2021 “Dirty Dozen”- Personal Information Cons

RogerRossmeisl

JULY 20, 2021

The post IRS 2021 “Dirty Dozen”- Personal Information Cons appeared first on Roger Rossmeisl, CPA.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

RogerRossmeisl

JULY 20, 2021

The post IRS 2021 “Dirty Dozen”- Personal Information Cons appeared first on Roger Rossmeisl, CPA.

RogerRossmeisl

JULY 20, 2021

On 6/28/21 the Internal Revenue Service, via IR 2021-135, began its “Dirty Dozen” list for 2021 with a warning for taxpayers, tax professionals and financial institutions to be on the lookout for these 12 nefarious schemes and scams.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The New Way CPAs are Delivering Value: Aligning Automation with Client Success

Profit in the Details: Rethinking Spend for Monumental Impact

Fall In Love With the Month-End Close

Building a Business Case for Finance Automation

Navigating Payroll Compliance: Future-Proofing Payroll in an Evolving Regulatory Landscape

RogerRossmeisl

JULY 20, 2021

The post IRS 2021 “Dirty Dozen” – Preying on Unsuspecting Victims appeared first on Roger Rossmeisl, CPA.

The New Way CPAs are Delivering Value: Aligning Automation with Client Success

Profit in the Details: Rethinking Spend for Monumental Impact

Fall In Love With the Month-End Close

Building a Business Case for Finance Automation

Navigating Payroll Compliance: Future-Proofing Payroll in an Evolving Regulatory Landscape

RogerRossmeisl

JULY 20, 2021

The post IRS 2021 “Dirty Dozen” – Pandemic-Related Scams appeared first on Roger Rossmeisl, CPA.

Speaker: Jim Bourke, Managing Director Advisory Services at WithumSmith+Brown

Protecting data does not and should not result in a massive disruption to our business model, but instead, should be viewed as an opportunity to get to better know our clients and help them by delivering new services that in the past were never associated with a CPA firm. October 21st, 2021 at 11:00 am PDT, 2:00 pm EDT, 7:00 pm BST

CPA Practice

DECEMBER 20, 2023

Top 200 accounting firm Honkamp recently added one of the 20 largest CPA firms in the St. The Dubuque, IA-based firm merged with Schowalter & Jabouri on Dec. The new location will be the first office in Missouri for Honkamp, and the merger increases the firm’s headcount to about 300 employees.

RogerRossmeisl

JANUARY 15, 2021

A 1/13/2021 U.S. Treasury Department Press Release reported that the SBA is re-opening the Paycheck Protection Program (PPP) loan portal: to small lenders on 1/15/2021, and to all lenders on 1/19/2021. Background On 12/27/2020, the Consolidated Appropriations Act, 2021 (CAA 2021) was signed into law.

TaxConnex

DECEMBER 21, 2021

Hiring is on the minds of many executives as we end 2021. And it’s especially hard to find professionals who know taxes: Finding qualified staff is an enduring, front-burner concern that continues to challenge even CPA firms this year. Teams are leaner than ever as existing employees quit, and new ones are harder to find.

RogerRossmeisl

JANUARY 9, 2021

In response to the ongoing Coronavirus Disease 2019 (COVID-19) pandemic, IRS Notice 2021-07 provides temporary relief for employers and employees using the automobile lease valuation rule to determine the value of an employee’s personal use of an employer provided automobile for purposes of income inclusion, employment tax, and reporting.

RogerRossmeisl

AUGUST 15, 2021

On 7/16/2021, Governor Newsom signed into law AB-150, which provides a means by which certain pass-through entities (Qualified Entities) can make an election to pay California income tax (at the entity-level) on behalf of their owners, for which their consent must be given. Curiously the IRS has approved.

RogerRossmeisl

AUGUST 5, 2021

From June 2020 through June 2021, the U.S. The post How New Business Start-up Expenses are Handled on your Tax Return appeared first on Roger Rossmeisl, CPA. Despite the COVID-19 pandemic, government officials are seeing a large increase in the number of new businesses being launched.

RogerRossmeisl

NOVEMBER 2, 2021

CAA 2021 Changes Within the Consolidated Appropriations Act of 2021 (signed into law on 12/27/20) was the Taxpayer Certainty and Disaster Tax Relief Act of 2020 (TCDTRA 2020). The post Taking Advantage of the WOTC (Work Opportunity Tax Credit) appeared first on Roger Rossmeisl, CPA. This means.

RogerRossmeisl

APRIL 17, 2021

As posted to Mike Frankovich’s YouTube Channel on 4/15/2021 (Run time: 8 min, 47 sec) If you’re like me, you have trouble understanding why California continues to make it so difficult to engage is what is one of the most quintessential of California pastimes. classic car ownership.

RogerRossmeisl

FEBRUARY 21, 2022

In the fourth quarter of 2021, CEO resignations were up 16% over the prior year, according to executive outplacement firm Challenger, Gray & Christmas. The post Don’t Discount the Key Person Discount appeared first on Roger Rossmeisl, CPA.

RogerRossmeisl

AUGUST 23, 2022

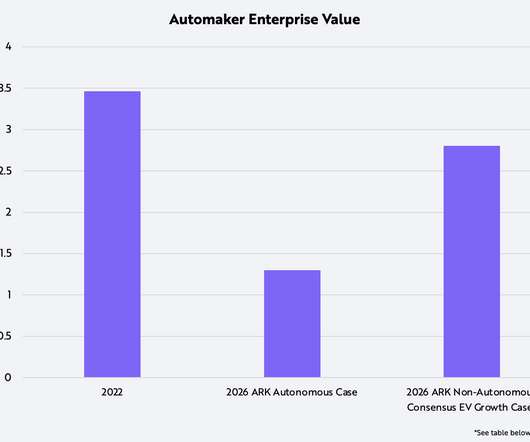

In 2021, the number of light vehicles sold globally was 78 million and the enterprise value of automakers, roughly $3.5 The post The Auto Industry is Likely to Decline in Enterprise Value appeared first on Roger Rossmeisl, CPA. According to IHS Markit, during the next five years unit auto sales will increase at a 4.7%

RogerRossmeisl

NOVEMBER 28, 2021

The post Recent FTB Clarifications on Pass-Through Entity Tax (AB-150) appeared first on Roger Rossmeisl, CPA. For calendar-year taxpayers, that is March 15, 2022. Logistics of PTE Tax Payments / K-1 Recipient Credits Prior to. Logistics of PTE Tax Payments / K-1 Recipient Credits Prior to.

RogerRossmeisl

DECEMBER 26, 2021

As posted to the Munro Live YouTube Channel on 11/24/2021 (Run Time 46 min, 32 sec) Regarding the accelerating move to EVs, legendary automotive engineer Sandy Munro believes that OEMs are experiencing Scotoma, aka Paradigm Paralysis. GM promised 20 new EVs by 2023, yet they brought zero to the recent 2021 LA Auto Show.

RogerRossmeisl

JANUARY 11, 2021

The Treasury Department and Small Business Administration (SBA) have released Interim Final Rules (IFR) regarding the permission of “second draw loans” under the Paycheck Protection Program (PPP) recently authorized by the Consolidated Appropriations Act, 2021 (CAA 2021).

RogerRossmeisl

NOVEMBER 28, 2021

As posted to the Now You Know YouTube Channel on 11/5/2021 (Run Time 29 min, 54 sec, when starting at time code 3:22) Now You Know sits down with legendary automotive engineer Sandy Munro in November 2021 to compare and contrast today’s unfolding Chinese EV rollout with the Japanese vehicle invasion of the 1970s and 1980s.

RogerRossmeisl

JANUARY 23, 2022

As posted to the RethinkX YouTube Channel on 11/04/2021 (Run Time 32 min, 32 sec) We are on the cusp of the fastest, deepest and most consequential transformation of civilization in history. The post Rethinking Humanity appeared first on Roger Rossmeisl, CPA. Desperate for stability and certainty.

Going Concern

JUNE 6, 2024

They’ve conveniently laid the results out in this chart: It’s encouraging to see staff compensation on the board for at least one category of firm. They might be *this close* to figuring out how closely that factor is tied to their talent problems.

Going Concern

AUGUST 11, 2022

That’s a whole extra 100 firms this year from the Top 400 they usually do. Here are your top 25 firms for 2022. We’ve included 2021 INSIDE Public Accounting Top 400 rankings in parenthesis for comparison: Deloitte (1). Cherry Bekaert (not top 25 in 2021). Big 4 firms made up nearly 71.5% Wipfli (20).

RogerRossmeisl

SEPTEMBER 27, 2021

If, instead, you use the standard mileage rate (56 cents per business mile driven for 2021), a depreciation allowance is built into the rate. The post Tax Depreciation Rules for Business Automobiles appeared first on Roger Rossmeisl, CPA.

CPA Practice

DECEMBER 22, 2023

Top 200 accounting firm Honkamp recently added one of the 20 largest CPA firms in the St. The Dubuque, IA-based firm merged with Schowalter & Jabouri on Dec. The new location will be the first office in Missouri for Honkamp, and the merger increases the firm’s headcount to about 300 employees.

RogerRossmeisl

JANUARY 15, 2021

Under the Economic Aid Act (EAA) in the Consolidated Apportionment Act (CAA 2021), certain borrowers may request an increase under certain conditions: First Draw Paycheck Protection Program Loan Increases After Enactment of the Economic Aid Act, 1/13/2021 SBA Procedural Notice Control No.

Going Concern

OCTOBER 20, 2023

Local CPA weighs in on accountant shortage [ WMDT ] The Salisbury, MD news spoke to a UHY partner about the issue. CPA at UHY Group Mark Welsh tells 47ABC that recruiting slowing down has meant firms are turning to AI, Bots, and international workers to help fill demand, raising prices as much as ten percent for end-users.

RogerRossmeisl

JANUARY 12, 2021

In a Treasury Department Press Release dated 1/8/2021, the Treasury Department and Small Business Administration (SBA) have announced that the Paycheck Protection Program (PPP) will reopen the week of January 11. The post SBA Releases Top Line Overview of First and Second Draw PPP Loans appeared first on Roger Rossmeisl, CPA.

RogerRossmeisl

JUNE 15, 2021

The Internal Revenue Service recently reminded businesses (in News Release 2021-47) of their responsibility to report large cash transactions via the filing of Form 8300, Report of Cash Payments Over $10,000, and encourages e-filing to help them file accurate, complete forms. The short video points out sections of Form 8300 for which the IRS.

RogerRossmeisl

JANUARY 10, 2021

The Treasury Department and Small Business Administration (SBA) have released Interim Final Rules (IFR) regarding the recent extension and expansion of the Paycheck Protection Program (PPP) as authorized by the Consolidated Appropriations Act, 2021 (CAA 2021).

CapataCPA

MARCH 18, 2021

Individual Tax Deadline Extended to May 17, 2021 The Internal Revenue Service (IRS) and Treasury Department announced today the 2020 tax year federal income tax filing due date for individuals has been automatically extended from April 15, 2021 to May 17, 2021.

RogerRossmeisl

JULY 11, 2021

The Employee Retention Tax Credit (ERTC) is a valuable tax break that was extended and modified by the American Rescue Plan Act (ARPA), enacted in March of 2021. At that time, the ERTC applied to wages paid after March 12, 2020, and before January 1, 2021.

CPA Practice

NOVEMBER 11, 2024

The Public Company Accounting Oversight Board (PCAOB) revoked the registration of a Chinese audit firm on Nov. First, on multiple occasions, the accounting firm failed to timely report the participants in its issuer audits on PCAOB Form AP, in violation of PCAOB Rule 3211, Auditor Reporting of Certain Audit Participants.

Going Concern

JANUARY 6, 2023

2024 CPA Exam Blueprints released [ Journal of Accountancy ]. I’m an immigrant and I moved to the UK in 2021. based IPA 100 firm Withum (FY22 net revenue of $425.3 based IPA 200 firm O’Connor & Drew (FY21 net revenue of $22.1 CLA Acquires Ohio-Based CPA Firm Gilmore Jasion Mahler [ CPA Practice Advisor ].

CPA Practice

MARCH 15, 2023

The first major deal by a private equity firm to acquire controlling interest in a top 20 accounting firm happened as recently as 2021, when TowerBrook Capital acquired EisnerAmper’s tax and consulting practice for an undisclosed amount. Do they flip to venture capital, or to another CPA firm?

CPA Practice

AUGUST 12, 2024

Top 200 accounting firm Honkamp merged in Brems Group, a CPA firm with offices in Cedar Rapids and Coralville, Iowa, effective Aug. Dubuque, Iowa-based Honkamp said the new locations in Cedar Rapids and Coralville will increase the firm’s ability to provide CPA and business advisory services to even more clients.

RogerRossmeisl

JANUARY 14, 2021

For 2020 tax returns, the due date is February 1, 2021. The post California 1099-NEC Filing Requirements appeared first on Roger Rossmeisl, CPA. Starting in tax year 2020, payers must complete this form to report any payment of $600 or more to a payee. Generally, payers must file Form 1099-NEC by January 31.

KROST

NOVEMBER 24, 2021

KROST recognized our new CPA licensees at the CalCPA LA Chapter ABC Networking event on November 18th at the Luxe Hotel on Sunset in Hollywood. Congratulations to: Shelby Anna Brennan, CPA. Hoang Lan N Ho, CPA. Kimberly May Hoang, CPA. Cara Wang, CPA. Kejing Wang, CPA. Huanye Xu, CPA. Jing Yin, CPA.

RogerRossmeisl

APRIL 17, 2021

The California Department of Tax and Fee Administration (CDTFA) has updated Publication 34 (Motor Vehicle Dealers), to include 2020 legislation that, effective 1/1/2021, imposes new reporting and payments requirements on certain used vehicle dealers. Publication 34 is designed to help motor vehicle dealers understand California’s.

RogerRossmeisl

SEPTEMBER 30, 2021

Low interest rates and other factors have caused global merger and acquisition (M&A) activity to reach new highs in 2021, according to Refinitiv, a provider of financial data. It reports that 2021 is set to be the biggest in M&A history, with the United States accounting for $2.14

Dent Moses

SEPTEMBER 20, 2024

Earlier this year, we wrote about beneficial ownership information (“BOI”) reporting requirements of the Corporate Transparency Act (“CTA”) signed in to law in January 2021. The BOI report filing is not a tax filing, which means CPA firms do not have clear legal authority to prepare these reports for clients.

CPA Practice

SEPTEMBER 5, 2024

Top 20 accounting firm EisnerAmper is expanding its presence in the Chicago area by merging in Elgin, IL-based CPA firm Tighe, Kress & Orr. Since receiving private equity backing in 2021, EisnerAmper has completed several M&A deals with smaller firms to expand its footprint throughout the U.S.

RogerRossmeisl

JUNE 16, 2021

rate for Social Security up to a certain maximum ($142,800 for 2021) and at a 2.9% The post An S Corporation Could Cut Your Self-Employment Tax appeared first on Roger Rossmeisl, CPA. Fundamentals of self-employment tax The self-employment tax is imposed on 92.35% of self-employment income at a 12.4% rate for Medicare.

RogerRossmeisl

APRIL 13, 2021

Current exemption amounts For 2021, the federal estate and gift tax exemption is $11.7 The post How to Ensure Life Insurance Isn’t Part of Your Taxable Estate appeared first on Roger Rossmeisl, CPA. That way, the benefits won’t be subject to federal estate tax. million ($23.4 million for married couples).

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content