What to Do if You Missed the April 18 IRS Income Tax Filing Deadline

CPA Practice

APRIL 24, 2023

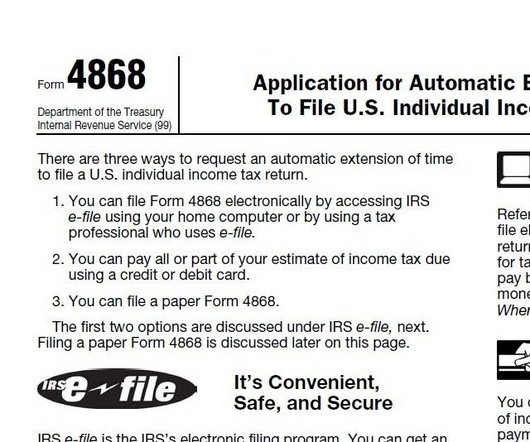

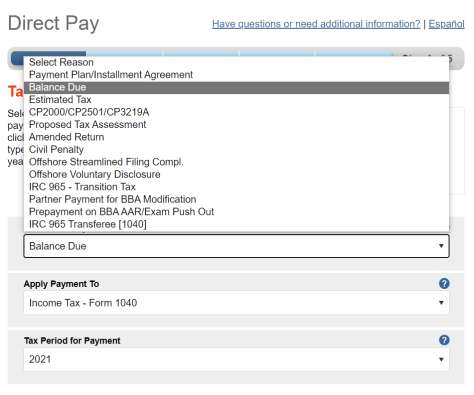

The IRS also notes that taxpayers who are owed a refund won’t be penalized or fined for filing late, but people shouldn’t overlook filing a tax return when they are due a refund… unless you really want to basically donate that money (your money) to the IRS. 16 to prepare and file 2022 tax returns electronically.

Let's personalize your content