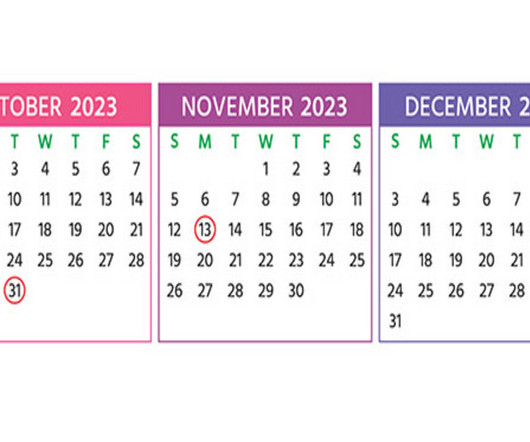

2023 Q4 Tax Calendar: Key Deadlines for Businesses and Other Employers

RogerRossmeisl

NOVEMBER 8, 2023

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2023. Note: Certain tax-filing and tax-payment deadlines may be postponed for taxpayers who reside in or have businesses in federally declared disaster areas.

Let's personalize your content