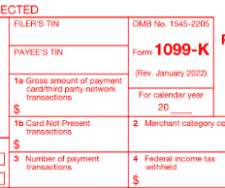

Year-End Tax Planning Ideas for your Small Business

RogerRossmeisl

SEPTEMBER 25, 2022

Now that Labor Day has passed, it’s a good time to think about making moves that may help lower your small business taxes for this year and next. For example, you could pull income into 2022 to be taxed at lower rates, and defer deductible expenses until 2023, when they can be claimed to offset higher-taxed income.

Let's personalize your content