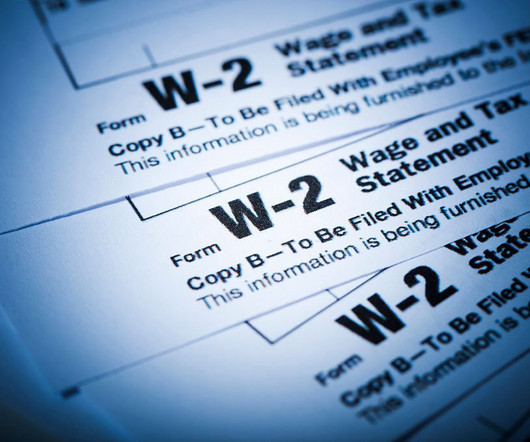

W2 Statements Due to Employees and SSA by Jan. 31, 2023

CPA Practice

JANUARY 26, 2023

Filing these documents timely prevents late-filing penalties for employers, helps employees file their income tax returns and prevents tax fraud. Employers must also provide copies B, C and 2 of Form W-2 to their employees by January 31, 2023. and their payroll tax returns (Forms 941, 943, 944, etc.)

Let's personalize your content