Tax Strategy: Year-end 2023 tax planning

Accounting Today

OCTOBER 25, 2023

In spite of the lack of new tax legislation so far this year, taxpayers and tax preparers have plenty to focus on in preparing 2023 returns.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Accounting Today

OCTOBER 25, 2023

In spite of the lack of new tax legislation so far this year, taxpayers and tax preparers have plenty to focus on in preparing 2023 returns.

RogerRossmeisl

SEPTEMBER 25, 2022

For example, you could pull income into 2022 to be taxed at lower rates, and defer deductible expenses until 2023, when they can be claimed to offset higher-taxed income. Here are some other ideas that may help you save tax dollars if.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Next-Level Fraud Prevention: Strategies for Today’s Threat Landscape

Outsourcing Vs. In-House: The Ultimate Battle For Better Collections

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

The Silent Crisis: Why Finance Lags in Digital Transformation and How to Accelerate AI Adoption

RogerRossmeisl

DECEMBER 3, 2023

In the midst of holiday parties and shopping for gifts, don’t forget to consider steps to cut the 2023 tax liability for your business. In certain circumstances, The post There May Still Be Time to Reduce your Small Business 2023 Tax Bill appeared first on Roger Rossmeisl, CPA.

Next-Level Fraud Prevention: Strategies for Today’s Threat Landscape

Outsourcing Vs. In-House: The Ultimate Battle For Better Collections

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

The Silent Crisis: Why Finance Lags in Digital Transformation and How to Accelerate AI Adoption

Cherry Bekaert

NOVEMBER 29, 2023

Prepare for the 2023 tax season with our comprehensive tax planning checklist for individuals. Expert advice on life changes, investments, IRAs, and estate planning. Do you make charitable contributions? Do you receive income from a pass-through business? How will your income change in 2024?

Cherry Bekaert

NOVEMBER 14, 2023

Contributor: Chelsea Payne , Senior Manager, Tax Services As the end of the year approaches, strategic planning remains crucial for taxpayers looking to optimize their financial positions and set the stage for a strong start in the upcoming fiscal year.

Withum

FEBRUARY 3, 2025

As part of the change in law, bonus depreciation is scheduled to be phased down to zero in 20% increments from 2023 through the end of 2026. Regularly reviewing your interest expenses and adjusted taxable income is a smart tax planning strategy. million of assets to shorter depreciable tax lives, the dealership realized over $2.3

Withum

JANUARY 20, 2023

As you navigate our complicated tax code, you need a partner and important information in order to make the appropriate adjustments. This tax pocket guide is an essential resource that will help you evaluate and estimate your 2023 tax obligations.

Withum

DECEMBER 11, 2023

Upon viewing, you will be able to: Understand recent updates to state and federal tax laws Prepare for open possibilities in the political landscape to come Begin their tax planning process with a knowledgeable background on significant considerations The post On-Demand Webinar: 2023 Year-End Tax Planning for Law Firms and Attorneys appeared first (..)

Going Concern

NOVEMBER 7, 2024

90% plan to increase fees for individual tax returns, 87% plan to increase fees for business tax returns, 85% plan to increase fees for bookkeeping and accounting, and 76% plan to increase fees for CFO and controller services. 57% of accounting firms plan to increase fees across all services in 2025.

TaxConnex

NOVEMBER 2, 2023

October 15 th ended the last major income tax due dates in 2023. Most CPAs use the fourth quarter of the year for audit and tax planning for clients, strategic planning for the firm and of course, CPE. Look out for our December webinar for an additional CPE credit!)

Withum

NOVEMBER 17, 2022

Most of the income tax proposals in the 2021 “Build Back Better” bill did not make it into the IRA. General Income Tax Planning. Postpone income until 2023 and accelerate deductions into 2022. Estate Tax Planning. million in 2023). The annual exclusion increases to $17,000 in 2023.

Anders CPA

AUGUST 2, 2022

Crypto Tax Planning for 2022. Brokers are now required to report cryptocurrency transactions on Form 1099-B, including a customer’s basis, beginning after 2023. Anders is keeping an eye on evolving reporting requirements and tax treatment of cryptocurrencies. Contact an Anders advisor below to learn more. CONTACT ANDERS.

CPA Practice

SEPTEMBER 19, 2023

Goralka, Kiplinger Consumer News Service (TNS) This cautionary tale is based upon the recent tax case of Estate of Hoensheid v Commissioner , TC Memo 2023-34. When owners of a company plan to sell their business, there is very often a desire to minimize the resultant income tax. Creative solutions may be available.

Canopy Accounting

JANUARY 20, 2023

There are many interesting changes in business taxation for the 2023 season! Since tax planning for businesses is an important part of our practice, there are several things we need to be aware of.

MyIRSRelief

SEPTEMBER 1, 2020

With more than 30 million small businesses in the US, effective tax planning is essential to maximizing profits and minimizing taxes, keeping more of what is earned, and lowering your taxes for the future. This may maximize profits; minimize taxes for the year depending on what was purchased.

Cherry Bekaert

NOVEMBER 28, 2023

There are several key tax considerations and tactical approaches for businesses to address while closing out 2023 and moving into 2024. From leveraging tax incentives to optimizing deductions, this guide offers insights into tax planning to help businesses make informed decisions and set a solid foundation for the upcoming year.

ThomsonReuters

NOVEMBER 9, 2023

Year-end strategy #3: Shift your value proposition to advisory By using technology to automate traditional tax compliance work, more and more accounting firms are engaging clients based on the value and experience they bring to the table.

Anders CPA

DECEMBER 18, 2023

To help the construction industry understand the changing tax landscape and prepare for year-end, Anders partnered with Construction Industry CPAs and Consultants (CICPAC) to publish a 2023 Tax Planning Opportunities for the Construction Industry report. Learn more about how Anders works with the construction industry.

CPA Practice

APRIL 17, 2023

But even basic tax planning can make a big difference in reducing future tax liability. This makes having a reliable tax planning system that can look forward several years a valuable addition to a practice. Multiple responses were allowed, so totals equal more than 100%: Facebook 39.7% LinkedIn 33.9% Twitter 12.5%

CPA Practice

APRIL 19, 2023

According to Caseware’s 2023 State of Accounting Firms Trend Report , more than 90% of accountants and 95% of auditors find hiring skilled talent challenging. As a leader in your firm, you likely have ambitious goals to impact your clients’ bottom lines and grow your firm. Fortunately, it is possible to grow your team and meet your goals.

Shay CPA

NOVEMBER 29, 2023

It’s your year-end tax planning to-dos. Taking some time to get yourself sorted could mean thousands of dollars of savings between your startup’s income, payroll, sales, and foreign taxes. This applies to the 2023 tax year and is a huge dip from the $20,000 reporting threshold in previous years.

Cherry Bekaert

NOVEMBER 14, 2023

When your business is closing out 2023 and preparing for 2024, it’s the perfect time to delve into actionable strategies that will empower you to maximize your tax savings. Contact Us The post 2023 Year-End Tax Planning Strategies for Businesses appeared first on Cherry Bekaert.

ThomsonReuters

JANUARY 4, 2024

But where do you begin building your tax planning strategy? Tax planning strategy #1: Utilize short-term staffing solutions As tax season begins, firms in need of a short-term boost in headcount should consider outsourcing services to increase workload capacity.

Cherry Bekaert

NOVEMBER 15, 2023

As we approach the close of 2023, it’s your chance to seize those last-minute tax opportunities and brace for upcoming tax law changes that will reshape 2024. Contact Us The post 2023 Year-End Tax Planning Strategies for Individuals appeared first on Cherry Bekaert.

Cherry Bekaert

NOVEMBER 27, 2023

Contact Us The post 2023 Year-End Tax Planning Strategies for Technology Companies appeared first on Cherry Bekaert.

SkagitCountyTaxServices

MARCH 17, 2023

Getting into planning mode is going to require you actively carving out some time in your busy business owner schedule… whether you’re facing doing taxes on your own (not recommended) or meeting up with your favorite tax pro (wink, wink). As of 2023, it’s scheduled to reduce every year. Check with us.

CPA Practice

SEPTEMBER 6, 2023

Award winners are listed in alphabetical order. == 2023 Winners: Avalara Property Tax [link] Avalara Property Tax is a digital business solution for real and personal property tax management designed to improve tax compliance with automation.

Anders CPA

DECEMBER 8, 2022

The end of the year is an opportunity to get your affairs in order for the year ahead, and when it comes to tax planning, the sooner you begin preparations the better. As 2023 approaches, there are actions that can be taken now to offset or minimize your tax burden. Qualified Business Income (QBI) Optimization.

Ryan Lazanis

MAY 24, 2023

Here is my complete guide to emerging accounting technologies for 2023. Over and above just automating completion of tax forms, however, we’ll also start to see tax planning become an automated technology, which is discussed later on in this article. Which of the new related technologies do you want to leverage first?

CPA Practice

DECEMBER 21, 2023

To help companies and individual taxpayers understand their planning options, Grant Thornton LLP, one of America’s largest professional services firms, has released 2024 tax-planning guides for businesses and individuals. Prepare for public stock buyback tax. Tax-planning considerations for individuals 1.

Anders CPA

NOVEMBER 21, 2023

Year-end is approaching fast, which means this is the perfect time for businesses to make some final adjustments to their tax planning strategies. Consulting with a trusted tax professional to determine your eligibility for certain deductible activities is the best way to maximize your tax savings.

CPA Practice

JULY 31, 2023

Morris has over 10 years of public accounting experience in various areas of tax compliance and consulting. He is experienced in working with the management of closely held businesses in implementing tax-planning strategies, as well as providing private equity and capital groups with tax forecast, advisory and compliance-related services.

Withum

NOVEMBER 14, 2023

Key Figures – Estate and Gift Taxes Below is a summary of key figures related to Estate and Gift Taxes. Key Figures – Estate and Gift Taxes Below is a summary of key figures related to Estate and Gift Taxes. These adjustments are accessible on the IRS website in Revenue Procedure 2023-34.

CPA Practice

NOVEMBER 16, 2023

With the tax landscape continually evolving, Marcum LLP has released its 2023 Year-End Tax Guide. The guide features a detailed analysis of the current tax environment and spans more than 135 pages. The tax guide is available at [link]

inDinero Tax Tips

DECEMBER 22, 2023

Introduction As 2023 draws to a close, it’s pivotal for small businesses to scrutinize their financial status and strategize effectively for tax reduction and a robust financial future. Despite a static tax legislative landscape, the looming possibility of future amendments necessitates proactive tax planning.

Withum

NOVEMBER 29, 2022

The real estate industry has gotten very comfortable with the luxury of having 100 percent bonus depreciation on certain asset classes since it was re-enacted by the Tax Cuts and Jobs Act on September 27, 2017. An advantage of planning early is avoiding delays caused by recent production trends. Contact Us. Let’s Chat.

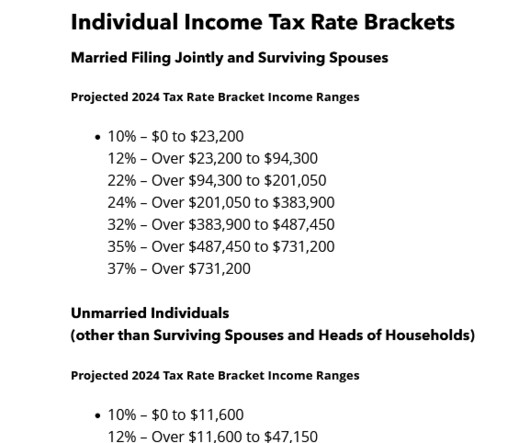

CPA Practice

SEPTEMBER 14, 2023

Bloomberg Tax & Accounting released its 2024 Projected U.S. Tax Rates, which indicates inflation adjusted amounts in the tax code will increase 5.4% increase in 2023, it is nearly double the 2022 increase of 3%. See projected tax bracket tables below.] Bloomberg Tax’s annual Projected U.S.

Withum

FEBRUARY 20, 2024

Our 2024 Tax Pocket Guide, which provides valuable updates and information including a chart of the most common tax rates for individuals and businesses, is a concise snapshot that provides the basics to help you start the tax planning process.

KROST

DECEMBER 12, 2022

In the last few months of the year, it is important to consider year-end tax planning opportunities as many may provide both immediate and long-lasting financial benefits. Businesses that have not yet explored year-end tax planning should take an immediate inventory of their situation to Read the full article.

ThomsonReuters

NOVEMBER 21, 2023

Jump to: Set engagements and expectations for next year Address economic pressures that are top of mind Advise on tax planning topics As the year comes to a close, most accounting firms are guiding clients through the complexities of year-end tax planning. This goes into effect on January 1, 2024.

Cherry Bekaert

DECEMBER 12, 2023

Cherry Bekaert’s State and Local Tax team dive into the dynamic world of state and local tax planning with our upcoming webinar. Gain valuable insights derived from real client experiences throughout 2023 and equip yourself with the knowledge needed to proactively plan for 2024.

Inform Accounting

FEBRUARY 27, 2024

With the closure of the 2023 tax year approaching on April 5, 2024, there remains an opportunity to assess your tax strategies and capitalise on current year-end possibilities.

CPA Practice

APRIL 17, 2023

But with the increasing complexity of modern business and regulations, and a worsening shortage of CPAs, the truth is that small business accountants rarely help clients optimize their tax strategies. Still, the failure to recognize the importance of proper tax planning adds up. So what should business owners do?

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content