IRS Provides Relief to Taxpayers Impacted by Hurricane Helene

Withum

OCTOBER 3, 2024

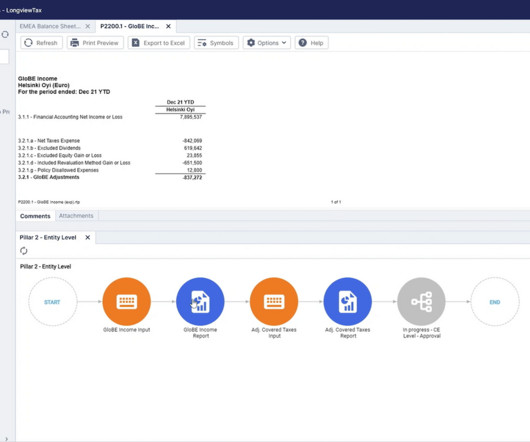

The tax relief postpones certain tax filing and payment deadlines that started as early as September 22, 2024, to May 1, 2025. May 1, 2025 2024 Form 1065 March 15, 2025 *Postponement date would allow a proper extension until October 30, 2025. What does the filing and payment relief apply to?

Let's personalize your content