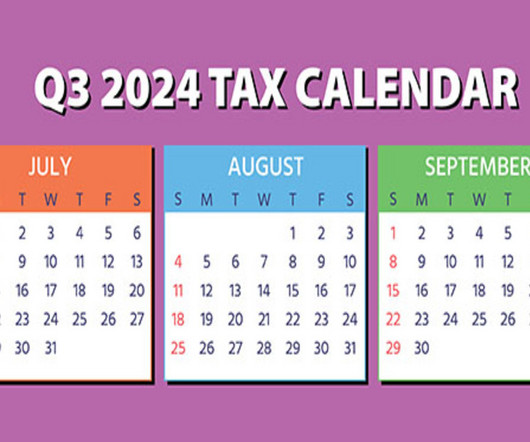

2024 Q3 Tax Calendar: Key Deadlines for Businesses and Other Employers

RogerRossmeisl

JULY 17, 2024

July 15 Employers should deposit Social Security, Medicare and withheld income taxes for June if the monthly deposit rule applies. They should also deposit non-payroll withheld income tax for June if the monthly deposit rule applies. If a calendar-year S corporation.

Let's personalize your content