How to File a Deceased Person’s Final Income Tax Return

CPA Practice

MARCH 1, 2023

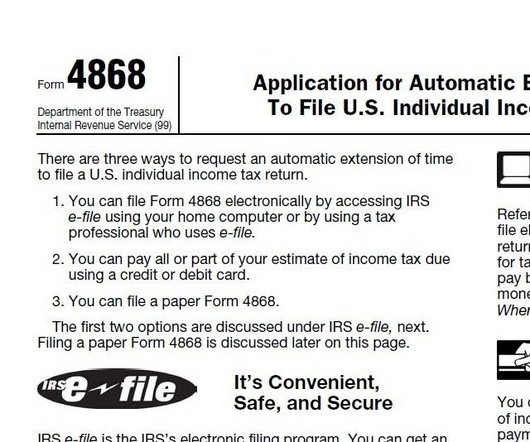

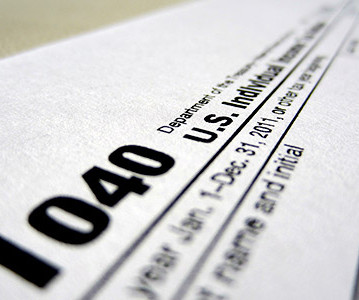

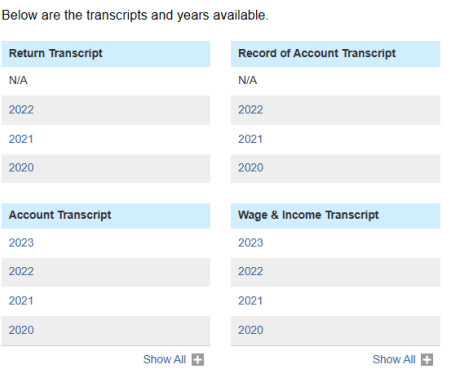

Unfortunately, when someone is deceased, the decedent’s personal representative is generally required to file any final tax returns for the deceased person. That includes federal income tax returns, that the decedent would have been required to file for the year of his or her death. 31, 2022, you can file a joint 2022 return.

Let's personalize your content