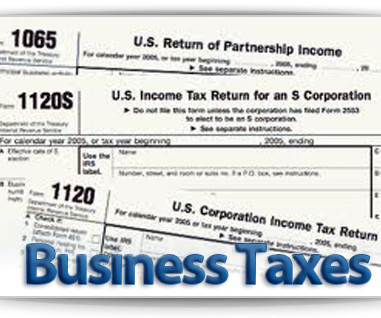

Navigating Potential Changes to Corporate Tax Rates

Insightful Accountant

MAY 13, 2024

Small business owners and tax practitioners are debating whether to elect S corporation status before the potential corporate tax rate increase in 2025 due to the expiration of TCJA provisions.

Let's personalize your content