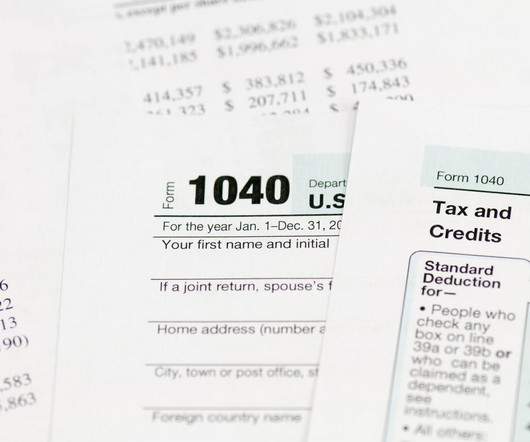

How Inflation Will Affect Your 2024 and 2025 Tax Bills

RogerRossmeisl

DECEMBER 29, 2024

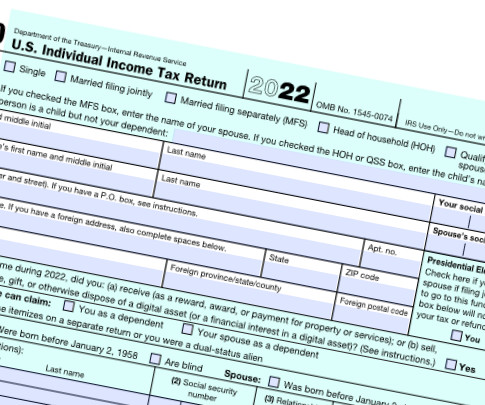

While recent inflation has come down since its peak in 2022, some tax amounts will still increase for 2025. A larger standard deduction will shelter more income from federal income tax next year. The highest tax rate. For 2025, the highest. Here are the highlights. Standard deduction.

Let's personalize your content