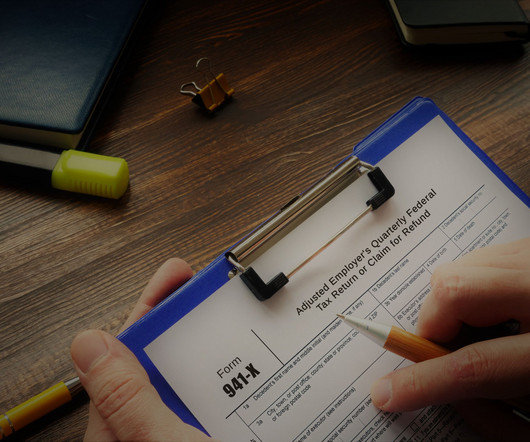

An Employer’s Guide to Multi-State Payroll Tax Withholding for Remote Workers

Anders CPA

MAY 23, 2023

Remote workers have become a staple of the workplace, but hiring out-of-state employees can lead to payroll tax complications. Multi-state payroll tax withholding done incorrectly can lead to penalties and interest for employers and create tax headaches for employees.

Let's personalize your content