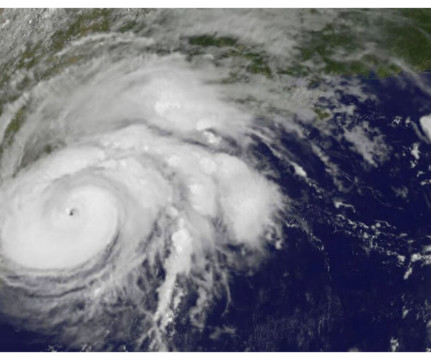

IRS Extends Tax Deadlines for Hurricane Debby Victims in the Southeast

Withum

AUGUST 14, 2024

The relief provided in IR-2024-205 postpones various tax filing and payment deadlines that occurred beginning on August 1, 2024, in Florida, August 4, 2024, in Georgia and South Carolina, and August 5, 2024, in North Carolina – the postponement period.

Let's personalize your content