How Your Business Can Prepare For and Respond to an IRS Audit

RogerRossmeisl

OCTOBER 20, 2024

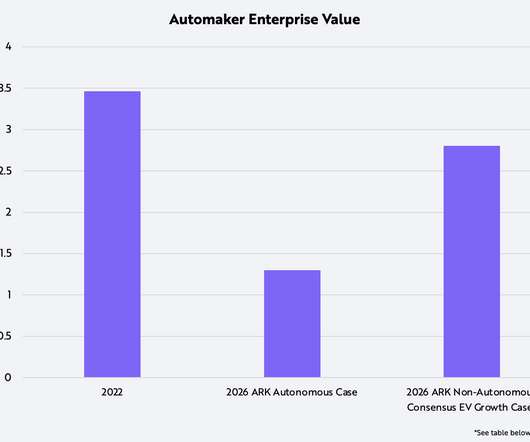

By 2026, it plans to nearly triple its audit rates for large corporations with assets exceeding $250 million. Under these plans, partnerships with assets over $10 million will also see audit rates increase tenfold by 2026. The post How Your Business Can Prepare For and Respond to an IRS Audit appeared first on Roger Rossmeisl, CPA.

Let's personalize your content