IRS extends Free File through 2029

Accounting Today

MAY 22, 2024

The program with third-party tax vendors will continue for another five years despite the IRS's recent Direct File pilot test.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

2029 Related Topics

2029 Related Topics

Accounting Today

MAY 22, 2024

The program with third-party tax vendors will continue for another five years despite the IRS's recent Direct File pilot test.

CPA Practice

MAY 22, 2024

The Free File program , a partnership between the IRS and tax preparation companies that make their online filing software available to eligible taxpayers for free, has been extended through 2029, the tax agency said on May 22. will continue the program through October 2029. from the 2.7

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Here's How To Fix Them

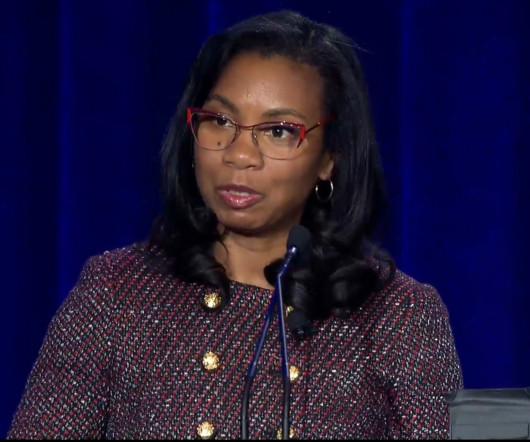

Going Concern

JUNE 11, 2024

Williams has been appointed for a second term that begins on October 25, 2024 and ends on that same day in 2029. The SEC announced today that current PCAOB Chair Erica Y. She’s been in the big chair at the PCAOB (no pun) since January of 2022 after she was brought in after a bit of a coup involving her predecessor William Duhnke.

Menzies

MARCH 26, 2025

If successful the reforms will increase annual housebuilding by around 30% by 2029-30, which the OBR estimates will add 6.8 National Planning Policy Framework Reforms Reforms of the National Planning Policy Framework (NPPF) were announced in December 2024 with the aim of increasing housebuilding in England. billion to the economy.

Menzies

MARCH 26, 2025

If successful the reforms will increase annual housebuilding by around 30% by 2029-30, which the OBR estimates will add 6.8 National Planning Policy Framework Reforms Reforms of the National Planning Policy Framework (NPPF) were announced in December 2024 with the aim of increasing housebuilding in England. billion to the economy.

TaxConnex

DECEMBER 7, 2023

State updates California has expanded its sales and use tax exemption for new, used or remanufactured trucks and new or remanufactured trailers or semitrailers delivered to a purchaser in state for use in interstate commerce to include used trailers or semitrailers. The sunset of this expanded exemption is also extended to Jan.

CPA Practice

OCTOBER 25, 2024

24, 2029. “I Erica Williams was sworn in by the Securities and Exchange Commission for her second term as chair of the Public Company Accounting Oversight Board on Oct. Her new five-year term officially begins today and lasts through Oct. capital markets to build their American dream,” Williams said in a statement.

Accounting Today

OCTOBER 25, 2024

24, 2029. Williams, who began her first term in January 2022, will now helm the Public Company Accounting Oversight Board through Oct.

CPA Practice

SEPTEMBER 11, 2024

Under the program, Coloradans will save an estimated $140 million a year in filing fees, and the system will help residents qualify for $80 million-plus in federal tax credits by 2029, according to an analysis by the Economic Security Project. The study was cited by Gov. Jared Polis’ office when announcing the change this week.

CPA Practice

JANUARY 18, 2024

He said a “trainwreck” is unfolding, estimating that it will take banks eight to ten years to transfer to post-quantum protocols, while scalable quantum computers will be available by 2029 or 2030. Anything that uses encryption, from ecommerce to online banking, is at risk, according to Hidary.

Cherry Bekaert

JUNE 18, 2024

The new credit is set to expire on January 1, 2029. The credit is nonrefundable and unused tax credit may be carried forward five years. The total credit for all taxpayers is capped at $1 million annually.

TaxConnex

AUGUST 9, 2022

If the revenue from the gross receipts tax in any single fiscal year from 2026 to 2029 is less than the 95% of the previous year’s revenue, the rate will return to 5.125% on the following July 1. The rate has dropped from 5.125% to 5%. A further reduction to 4.875% is slated for mid-2023.

CPA Practice

AUGUST 1, 2024

With the administration’s budgets planning to spend nearly $100 million from our Rainy Day Fund between now and 2029, this outcome will cost the City another roughly $22 million in additional revenue in that same period.” “It’s time to get honest about the reality of City finances and prepare for the challenging years ahead,” Ms.

PYMNTS

OCTOBER 21, 2019

You don’t need a subscription for this brief trip down memory lane — but the way things are going, you might one day. Think back to 2009, just as Recurly CEO Dan Burkhart and Karen Webster of PYMNTS did during a recent discussion about all that has changed in the past decade when it comes to subscription commerce.

CPA Practice

MARCH 11, 2024

IRC Section 461(l) disallows EBLs for taxpayers other than C corporations for tax years beginning after 2020 and before 2029. The letter also provides recommendations to help the IRS deliver practical guidance that would be helpful to both taxpayers and tax practitioners.

PYMNTS

OCTOBER 29, 2018

billion: Amazon North American sales in Q3. 6 billion: Number of new credit cards circulated each year. billion: Value of the U.K. subscription box market by 2022. 279 million: Number of Amazon Prime subscribers estimated in the U.S. 52 percent: Grubhub’s year-over-year revenue growth to $247.2 million.e.

CPA Practice

JANUARY 17, 2023

The US Bureau of Labor Statistics projects that employment of accountants and auditors will increase by 4% between 2019 and 2029, which is about in line with the predicted average for all occupations. This has facilitated a rapid growth in interest shown for such accounting qualifications. Accounting is ranked No.

Accounting Insight

MARCH 26, 2025

billion boost to the economy and housebuilding at its highest level in over 40 years by 2029-30. larger in 2029-30 because of the reforms worth around 6.8 billion lower in 2029-30. billion in 2029-30. The Chancellor also announced a package of measures to close the tax gap, raising 1 billion per year by 2029-30.The

ThomsonReuters

NOVEMBER 17, 2022

However, legislation enacted at the end of 2019 reinstated the PCOR provision, continuing the fee requirements through plan years ending before October 1, 2029 (see our Checkpoint article ). Because the ACA provision included an expiration date, PCOR fees originally were collected only for plan years ending before October 1, 2019.

CPA Practice

JULY 31, 2024

yearly starting in 2029. Administrative costs would eat between $200,000 and $540,000 annually for the first couple of years, then stabilize at about $160,000 per year. The state anticipates administrative costs will increase by 1.5% How would a retail delivery fee affect Washington consumers?

Airbase

OCTOBER 25, 2023

billion by 2029, at a CAGR of 10.9%. As this problem grew, so did interest in solutions to fix it, with more software companies introducing procurement solutions. The global market for procurement software grew by over 6% from 2019 to 2020 and is projected to grow to $13.80

Going Concern

JUNE 2, 2022

18 May 2029. Mark your calendars for the next eight National Pizza Party Days, surely some admin in your office in charge of ordering stacks of ‘za to keep you all from revolting already has. National Pizza Party Day dates. 19 May 2023. 17 May 2024. 16 May 2025. 15 May 2026. 21 May 2027. 19 May 2028. 17 May 2030.

PYMNTS

SEPTEMBER 2, 2020

employment will increase by six million jobs over the decade from 2019 through 2029, going from 163 million to 169 million in that timeframe. In a report issued on Tuesday (Sept. 1), the federal Bureau of Labor Statistics (BLS) predicted that U.S.

CPA Practice

MAY 24, 2024

Salo’s term on the FASB concludes on June 30, 2029, when she will be eligible for consideration for reappointment. In this capacity, she will succeed current FASB vice chair James L. Kroeker , whose final term on the FASB concludes June 30, 2024.

PYMNTS

JUNE 22, 2020

Valentino began its lease in the summer of 2013, and it concludes in 2029, for three floors as well as a basement. The brand, however, has removed the wood that has been guarding the outside of its store and has had curbside pickup available for products like T-shirts and purses.

ThomsonReuters

JANUARY 30, 2023

House Bill 2481 seeks to increase the minimum wage to $15 per hour by 2029 through incremental increases. The bill proposes a 25¢ decrease until 2029 where workers would be paid the full state minimum wage. House Bill 1125 would increase the minimum wage from $7.25 per hour to $15 per hour by 2025. West Virginia.

ThomsonReuters

JANUARY 6, 2022

However, legislation enacted at the end of 2019 reinstated the PCOR provision, continuing the fee requirements through plan years ending before October 1, 2029 (see our Checkpoint article ). Because the ACA provision included an expiration date, PCOR fees originally were collected only for plan years ending before October 1, 2019.

ThomsonReuters

DECEMBER 3, 2020

However, legislation enacted at the end of 2019 reinstated the PCOR provision, continuing the fee requirements through plan years ending before October 1, 2029 (see our Checkpoint article ). Because the ACA provision included an expiration date, PCOR fees originally were collected only for plan years ending before October 1, 2019.

VJM Global

AUGUST 7, 2024

Accordingly, show cause notice number section 74A can be issued by 30th June 2029 (i.e., Therefore, for FY 2024-25 , if the notice is issued on 30th June 2029 then the order is required to be issued by 30th June 2030. E.g. For FY 2024-25 , the due date for furnishing of annual return is 31st December 2025.

VJM Global

AUGUST 7, 2024

Accordingly, show cause notice number section 74A can be issued by 30th June 2029 (i.e., Therefore, for FY 2024-25 , if the notice is issued on 30th June 2029 then the order is required to be issued by 30th June 2030. E.g. For FY 2024-25 , the due date for furnishing of annual return is 31st December 2025.

CPA Practice

JULY 23, 2024

With the administration’s budgets planning to spend nearly $100 million from our Rainy Day Fund between now and 2029, this outcome will cost the City another roughly $22 million in additional revenue in that same period.” “It’s time to get honest about the reality of City finances and prepare for the challenging years ahead,” Ms.

Going Concern

JULY 10, 2024

And predictably, the cautious group doesn’t have as much faith in the pace of AI transformation between now and 2029 as the ambitious group. What exactly this work is will vary given the demographics of the respondent and what sort of work they do, obviously. For Gen Z, 15% landed in Ambitious and 15% Cautious.

PYMNTS

NOVEMBER 25, 2019

How Might Subscription Commerce Look In 2029? As PYMNTS research has demonstrated , 20.1 percent of consumer retail product subscribers plan to terminate their services in the next 12 months — a data point that should be on the mind of all merchants taking part in subscriptions. Recurly (@recurly) October 23, 2019.

Anders CPA

AUGUST 22, 2023

The credit will expire on December 31, 2029. If or when the tax credits exceed $1 million, then priority is given to the taxpayers who have been in business for less than five years, much like the recently reintroduced Missouri research and development (R&D) tax credit.

CPA Practice

JUNE 11, 2024

24, 2029, the SEC said on Tuesday. The Securities and Exchange Commission (SEC) has reappointed Erica Williams to a second term as chair of the Public Company Accounting Oversight Board (PCAOB), a move that signals stability at the audit regulator following the dismissal of its previous chairperson by SEC Chair Gary Gensler three years ago.

PYMNTS

SEPTEMBER 10, 2018

The analyst predicted that Amazon Prime subscriptions will hit 275 million by 2029 and that about 80 percent of all U.S. In the case of Prime , May thinks Amazon will end the year with 101 million paid subscribers, which is close to Netflix ‘s subscriber base of 117 million. households will use the service.

CPA Practice

MARCH 8, 2024

Or, it could regard House Bill 258 , which would require the Alabama Department of Revenue to recalculate the simplified sellers use tax rate annually, implementing the new rate starting September 1, 2029, each September 1 thereafter. Sales tax holiday season will soon be upon us.

PYMNTS

OCTOBER 29, 2019

In one example, he said the company had extended its global agreement with Citigroup for an additional five years to 2029, and will remain the bank’s exclusive partner for Citi branded credit and debit business.

PYMNTS

OCTOBER 18, 2019

Most (53 percent) of consumers could see fully automated vehicles on the market within two to 10 years, and more than half of Americans (55 percent) think most cars will have the ability to drive themselves by 2029.

VJM Global

JULY 14, 2024

Exemptions from GST IGST exemption on imports of specified items for defense forces is further extended for 5 years till 30th June, 2029. In line with Same, GST Council has recommended corresponding amendment in Section 9(1) of CGST Act.

VJM Global

JULY 14, 2024

Exemptions from GST IGST exemption on imports of specified items for defense forces is further extended for 5 years till 30th June, 2029. In line with Same, GST Council has recommended corresponding amendment in Section 9(1) of CGST Act.

Cherry Bekaert

AUGUST 29, 2023

The full credit only applies to components sold after December 31, 2022, and phases down for components sold after December 31, 2029. While the prevailing wage and apprenticeship bonus amounts are not available for this credit, taxpayers can utilize the direct pay and transferability options.

Menzies

MARCH 26, 2025

They also predict a rise on the average inflation to 3.2% next year before it begins to fall. The OBR have downgraded the UKs 2025 growth forecast from 2% to 1%. More positively, they have forecast growth to hit 1.9% in 2026, 1.8% in 2027, 1.7% in 2028 and 1.8%

CPA Practice

OCTOBER 18, 2023

But the algorithm and the quantum computing capabilities that can break decryption, some experts are saying could happen as early as 2020, by 2029, using Shor’s algorithm. Now, I’m thinking that that 2029 date is late, I’m thinking we’re gonna see some of this first breakage occurring in 2025 and 2026.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content