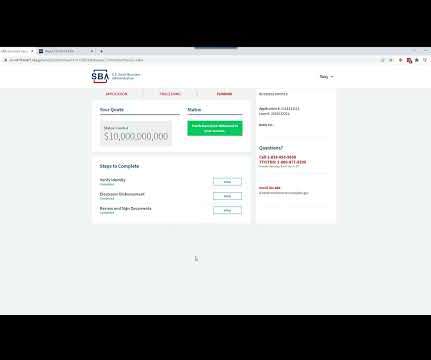

EIDL Rapid Portal Closes May 16 – Download Your Loan Docs NOW

Nancy McClelland, LLC

MAY 13, 2022

If you haven’t already, download a copy of your EIDL loan agreement documents, and snap a screenshot of your loan number and save it to PDF for easy reference. Your bookkeeper and accountant will thank you for this — and you’ll thank them for insisting you do it! What does this mean for you?

Let's personalize your content