Saving for College: Tax Breaks and Strategies Your Family Should Know

RogerRossmeisl

MARCH 3, 2025

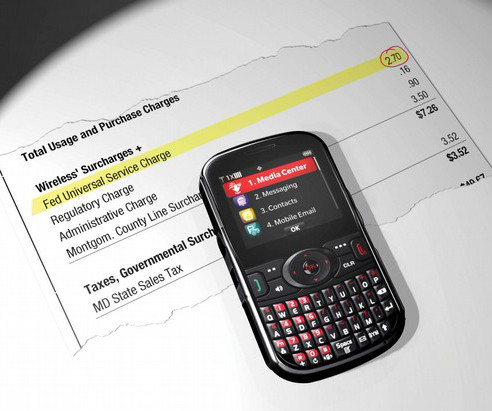

As higher education costs continue to rise, you may be concerned about how to save and pay for college. Below is an overview of some of the most beneficial tax breaks and planning options for funding your childs or grandchilds education. Fortunately, several tools and strategies offered in the U.S. Contributions arent deductible.

Let's personalize your content