FASB releases income tax disclosure standard

Accounting Today

DECEMBER 14, 2023

The Financial Accounting Standards Board issued an accounting standards update Thursday aimed at improving income tax disclosures from companies.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Accounting Today

DECEMBER 14, 2023

The Financial Accounting Standards Board issued an accounting standards update Thursday aimed at improving income tax disclosures from companies.

TaxConnex

MARCH 1, 2022

It’s that time of year again when everyone suddenly thinks about preparing their income taxes. But does tax preparation incur sales taxes – and if it does, where and how? Several states levy their sales tax or its equivalent on services, among them Hawaii (which has a general excise tax, or GET), and New Mexico.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Next-Level Fraud Prevention: Strategies for Today’s Threat Landscape

Outsourcing Vs. In-House: The Ultimate Battle For Better Collections

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

The Silent Crisis: Why Finance Lags in Digital Transformation and How to Accelerate AI Adoption

SMBAccountant

OCTOBER 21, 2020

These costs must be recorded in separate general ledger accounts to be easily identified and excluded from any billing. Bad Debt – both actual and estimated losses from uncollectible accounts receivable including collection costs and legal costs are not allowed. Most topics link directly to FAR clauses for further review.

Next-Level Fraud Prevention: Strategies for Today’s Threat Landscape

Outsourcing Vs. In-House: The Ultimate Battle For Better Collections

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

The Silent Crisis: Why Finance Lags in Digital Transformation and How to Accelerate AI Adoption

RogerRossmeisl

APRIL 17, 2024

If you have a tax-favored retirement account, including a traditional IRA, you’ll become exposed to the federal income tax required minimum distribution (RMD) rules after reaching a certain age. If you inherit a tax-favored retirement account, including a traditional or Roth IRA, you’ll also have to deal with these rules.

CPA Practice

MARCH 16, 2023

The Financial Accounting Standards Board released a proposed Accounting Standards Update (ASU) on Wednesday that addresses requests from investors for improved income tax disclosures.

CPA Practice

SEPTEMBER 14, 2023

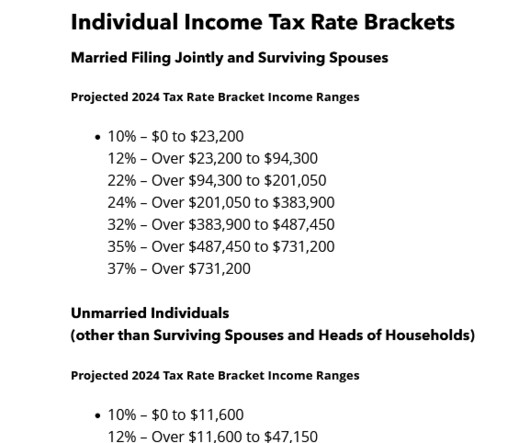

Bloomberg Tax & Accounting released its 2024 Projected U.S. Tax Rates, which indicates inflation adjusted amounts in the tax code will increase 5.4% See projected tax bracket tables below.] The report accounts for changes made under the Inflation Reduction Act and the SECURE 2.0

MyIRSRelief

JANUARY 16, 2023

When it comes to tax season, many people are faced with the decision of whether to prepare their own taxes or use an income tax preparation service. While it may seem like an added expense, there are many benefits to using a professional tax preparation service that make it well worth the cost.

Cherry Bekaert

FEBRUARY 27, 2024

On December 14, 2023, the Financial Accounting Standards Board (FASB) expanded income tax disclosure requirements for public and private companies. The expanded disclosure requirements are detailed in Accounting Standards Update No. 2023-09 (ASU 2023-09) and increase transparency of a filer’s global taxes.

CPA Practice

DECEMBER 14, 2023

The Financial Accounting Standards Board ( FASB ) has issued an Accounting Standards Update (ASU) that addresses requests for improved income tax disclosures from investors, lenders, creditors, and other allocators of capital (collectively, “investors”) that use the financial statements to make capital allocation decisions.

Accounting Today

AUGUST 30, 2023

The Financial Accounting Standards Board voted to require companies to tell the public more about the taxes they pay, starting as early as 2025.

TaxConnex

JULY 18, 2024

Sales Tax Accruals Ensure that sales tax is stated in your general ledger as a separate GL account number. This separation helps in clearly identifying and tracking sales tax amounts. Returns/Credits Returns and credits should be clearly identified in your accounting system.

Cherry Bekaert

FEBRUARY 12, 2024

On December 14, 2023, the Financial Accounting Standards Board (FASB) issued final guidance concerning income tax disclosures, labeled Accounting Standards Update No. For businesses surpassing specified quantitative thresholds, further disaggregation by taxing jurisdictions may be required. 2023-09 (ASU 2023-09).

inDinero Tax Tips

OCTOBER 22, 2024

LLC Taxes in Nevada Here are the primary reasons Nevada is an attractive place to start a business: While the average American pays 8.9% in state income tax, Nevada is one of a handful of states that doesn’t have personal income tax. That said, the state isn’t tax-free.

Bharmal&Associates

AUGUST 28, 2020

Single-member LLCs have one owner, although spouses who jointly own an LLC in a community property state can elect treatment as a single member LLC for federal income tax purposes. Single-Member LLC Tax Basics. You don’t need to file a separate federal income tax return for the single-member LLC. Three key points.

Withum

DECEMBER 18, 2024

Finance teams planning for their year-end financial statement audit have an even longer list of things to think about at the end of the year, including income statements, balance sheets, and, finally, the income tax provisions and disclosures that must be presented in the financial statements.

CPA Practice

FEBRUARY 28, 2024

The IRS started accepting and processing income tax returns on January 29, 2024. This article includes a handy reference chart taxpayers can use to estimate how soon they may get their income tax refund. When will I get my tax refund? ” The IRS and tax professionals strongly encourage electronic filing.

CPA Practice

DECEMBER 3, 2024

27)—A tax preparer who admitted to filing more than $3 million in fraudulent tax returns on behalf of her clients is facing up to 30 years in prison for her crime. The FBI and our law enforcement partners will continue to identify and hold accountable anyone who defrauds taxpayers.” (TNS) ATHENS, GA (Nov. Tripp” Self III.

RogerRossmeisl

MAY 15, 2023

The IRS recently issued some frequently asked questions addressing when certain costs are qualified medical expenses for federal income tax purposes. of your adjusted gross income. Basic rules and IRS clarifications You can claim an itemized deduction for qualified medical expenses that exceed 7.5%

Cherry Bekaert

FEBRUARY 12, 2024

The Financial Accounting Standards Board (FASB) released final guidance regarding income tax disclosures on December 14, 2023. Accounting Standards Update No. 2023-09 (ASU 2023-09) applies to all entities subject to income taxes and is intended to enhance the transparency and usefulness of income tax disclosures.

SMBAccountant

MARCH 8, 2023

One type of accounting that is well-known is tax accounting. According to Investopedia, tax accounting is “a structure of accounting methods focused on taxes rather than the appearance of public financial statements”. Tax accounting applies to individuals, businesses, and corporations.

RogerRossmeisl

APRIL 21, 2022

Items that are IRD, however, do have to be included in your income, although you may also be entitled to an IRD deduction on account of them. It is income that the decedent (the person from whom you inherit the property) would have taken into income on his or her final income tax return except that death interceded.

RogerRossmeisl

NOVEMBER 13, 2022

You don’t get a federal income tax deduction for a contribution, but the earnings on the account aren’t taxed while the funds are in the. The post Investing in the Future with a 529 Education Plan appeared first on Roger Rossmeisl, CPA.

RogerRossmeisl

AUGUST 6, 2023

If you own or manage a business with employees, there’s a harsh tax penalty that you could be at risk for paying personally. The Trust Fund Recovery Penalty (TFRP) applies to Social Security and income taxes that are withheld by a business from its employees’ wages. Taxes are considered the government’s property.

RogerRossmeisl

APRIL 21, 2022

If you’re employed by your own corporation, up to 25% of your salary can be contributed to your account, with a maximum contribution of $61,000. If you’re in the 32% federal income tax bracket, making a maximum contribution could cut what you owe Uncle Sam for 2022 by a whopping $19,520 (32% times $61,000).

TaxConnex

NOVEMBER 22, 2022

In our blog last week, we looked at how sales and use tax advisory services might be a good new field for CPAs and accounting firms. Accounting and CPA firms looking to expand their services into the sales and use tax niche, often have pent-up demand within their own client base. Review the sales tax payable account.

TaxConnex

AUGUST 18, 2022

has long included employees working in tax jurisdictions different from your office locations. But there may be soon: A recent Bloomberg survey found that three-quarters of states believe that just a few employees working in a state is enough to create tax nexus.

CPA Practice

OCTOBER 23, 2024

With the 2025 income tax filing season coming soon, the IRS is encouraging all taxpayers to take an important step to safeguard their identity by signing up for an identity protection personal identification number (IP PIN). How to request an IP PIN The best way to sign up for an IP PIN is through IRS Online Account.

Withum

FEBRUARY 27, 2025

IRS-CI is the law enforcement arm of the IRS tasked with investigating violations of income tax, money laundering, and Bank Secrecy Act laws. Its the only federal agency that dedicates 100% of investigative time to financial investigations and has sole authority to investigate violations of US income tax laws.

CPA Practice

NOVEMBER 10, 2024

As healthcare enrollment and renewal season continues, the Internal Revenue Service is reminding taxpayers that if they use flexible spending accounts (FSAs), they may be eligible to use tax-free dollars to pay medical expenses not covered by other health plans.

CPA Practice

JANUARY 6, 2025

Trifilo did not file federal income tax returns or pay all the taxes that he owed despite earning more than $7.7 million during that time.

TaxConnex

APRIL 20, 2021

This time of year, everybody’s mind is on income tax preparation. And for many accountants and CPA firms, this time of year means extra-long hours and more time spent managing clients’ finances. The fact is, when it comes to many companies’ federal and state income tax returns, they don’t rely on an automated income tax return.

CPA Practice

DECEMBER 11, 2024

Required minimum distributions (RMDs) are amounts that many retirement plan and IRA account owners must withdraw annually. These withdrawals are considered taxable income and may incur penalties if not taken on time. Inherited IRAs Beneficiaries of inherited IRAs, retirement plan accounts, or Roth IRAs may be required to take RMDs.

CPA Practice

FEBRUARY 13, 2023

It combines several elements of traditional 401(k) plans with Roth IRA features in designated accounts. As with a traditional 401(k) plan, eligible employees can elect to defer part of their salary to a Roth account, subject to annual tax law limits. Contributions benefit from tax-deferred growth within the account.

CPA Practice

APRIL 9, 2024

As accountants and CPAs, dealing with payroll taxes is essential to managing finances for your business clients. Understanding the details of payroll taxes helps you better assist your clients in fulfilling their obligations and maximizing tax efficiency. for paying state unemployment tax. By Nellie Akalp.

inDinero Tax Tips

JANUARY 1, 2025

When youre building a tech startup, accounting probably doesnt feel very exciting. In this article, well explore the essentials of tech startup accounting, including best practices, common mistakes, and the accounting software we think will make your life easier. Whats Unique About Tech Startup Accounting?

CPA Practice

JULY 26, 2024

Attrino, nj.com (TNS) A woman who worked as an accountant for a New Jersey company was sentenced Monday to more than three years in prison and ordered to pay $3.8 Vandever was indicted in February 2022 on multiple charges of fraud and tax evasion. By Anthony G. She pleaded guilty in September 2023 before federal Judge Karen M.

RogerRossmeisl

APRIL 28, 2024

If you’re employed by your own corporation, up to 25% of your salary can be contributed to your account, with a maximum contribution of $69,000. If you’re in the 32% federal income tax bracket, making a maximum contribution could cut what you owe Uncle Sam for 2024 by a whopping $22,080 (32% × $69,000).

MyIRSRelief

DECEMBER 15, 2022

How to fix my messy back-years accounting for my Los Angeles, CA business? If you have messy books for many back years of accounting, it can be overwhelming to try to organize and clean them up. This might include accounting software, a financial calculator, and reference materials such as tax guides or accounting textbooks.

TaxConnex

DECEMBER 3, 2024

The retailer hired an external CFO in 2021 who advised them that their large volume of online sales likely meant they had unpaid sales tax liabilities. The company ultimately paid $2 million in unpaid tax liabilities under various disclosures to 39 states, reports say. Rate hike on the bayou.

CPA Practice

AUGUST 19, 2024

By Matthew Enuco nj.com (TNS) A Drexel University accounting professor was convicted on all eight counts of tax evasion and filing false tax returns Thursday, U.S. million in income taxes on about $3.28 million in income. In total, Ndubizo failed to pay taxes on around $3.28

Withum

JANUARY 21, 2025

Each state has its own rulings regarding state income tax withholdings of 401(k) retirement plan distributions. Distributions of pre-tax employee elective contributions and employer contributions from a retirement plan are subject to a mandatory federal income tax of 20%.

CPA Practice

SEPTEMBER 8, 2023

The tax law provides benefits to employees who choose to participate in flexible spending accounts (FSAs) for qualified expenses. However, if there’s a balance in the account at the end of the year, the remaining funds are generally forfeited. Similarly, the employer saves on its share of payroll taxes.

CPA Practice

AUGUST 30, 2024

29—FARMINGTON — An accountant pleaded guilty in Bridgeport Thursday to filing fraudulent tax returns for multiple years after failing to report $1.4 million in income, federal officials said. Legowski prepared tax returns for between 400 and 500 individual clients, 50-60 businesses, the U.S. Attorney’s Office.

CTP

FEBRUARY 29, 2024

Complex tax laws for filing and deducting gambling winnings and losses provide new hurdles for taxpayers. So, as an accountant of a gambling client, you need to have detailed knowledge about gambling winnings and losses, as well as all the rules and regulations related to tax on gambling income.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content