How to Work with a Forensic Accountant

RogerRossmeisl

AUGUST 18, 2021

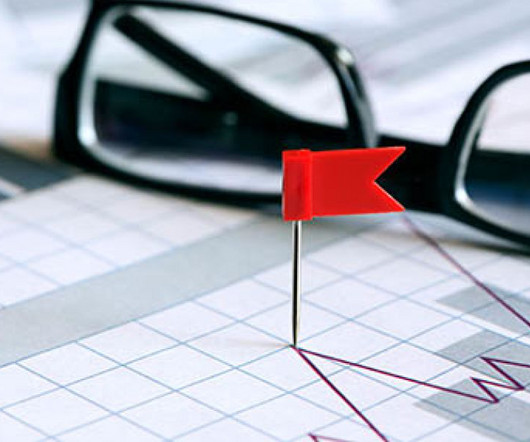

Forensic accountants are professionals who have received specialized training to uncover fraud and protect against fraud threats. They’re uniquely qualified to review financial statements and business records and to interview employees to find evidence of misrepresentations and theft.

Let's personalize your content