The Difference between Bookkeeping and Accounting

SMBAccountant

DECEMBER 21, 2022

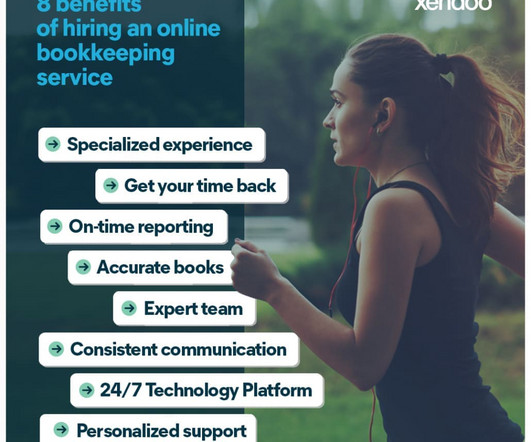

Bookkeeping and accounting are often used interchangeably when describing a process of recording financial transactions for a business, but they are not the same functions. Accountants also support management in the implementation and monitoring of internal controls. Tax accountants specialize in IRS law and completion of tax returns.

Let's personalize your content