Can Accounting Reports Really Be Beautiful?

DuctTapeMarketing

JUNE 27, 2014

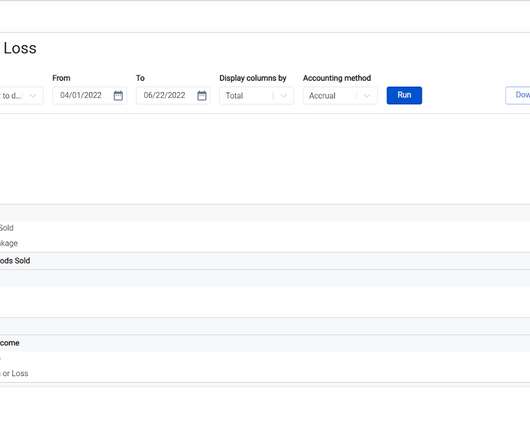

Small Business Finances. Can Accounting Reports Really Be Beautiful? Can Accounting Reports Really Be Beautiful? Accounting is frequently an overlooked area in small business as it does not hold the flash and appeal that some other areas of owning a business hold. Website Design. Advertising.

Let's personalize your content