What is a provision for income tax and how do you calculate it?

ThomsonReuters

SEPTEMBER 2, 2021

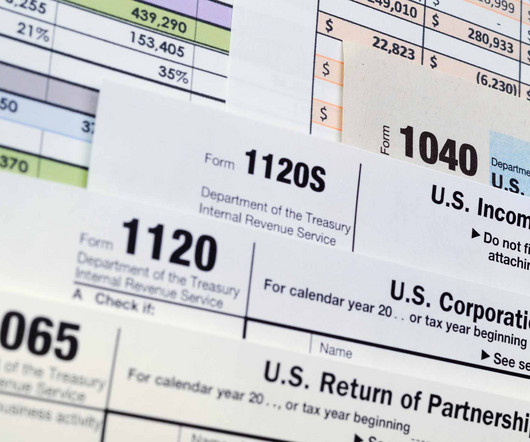

Simply put, a tax provision is the estimated amount of income tax that a company is legally expected to pay to the IRS for the current year. A tax provision is just one type of provision that corporate finance departments set aside to cover a probable future expense. How provision for tax is calculated.

Let's personalize your content