Sales Tax Accounting Basics [+ Journal Entry for Sales Tax Examples]

Patriot Software

SEPTEMBER 20, 2022

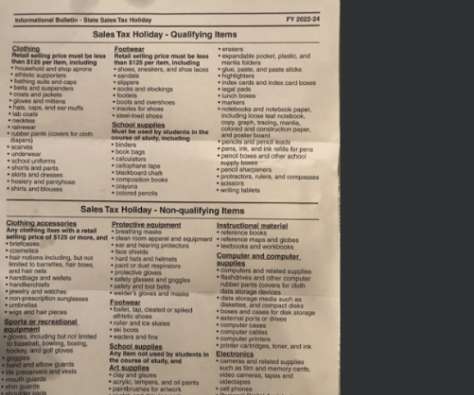

When you sell goods to customers, you likely collect and remit sales tax to the government. And when you purchase products, you typically pay sales tax. But, how do you record these tax collections and payments in your accounting books? Sales tax accounting.

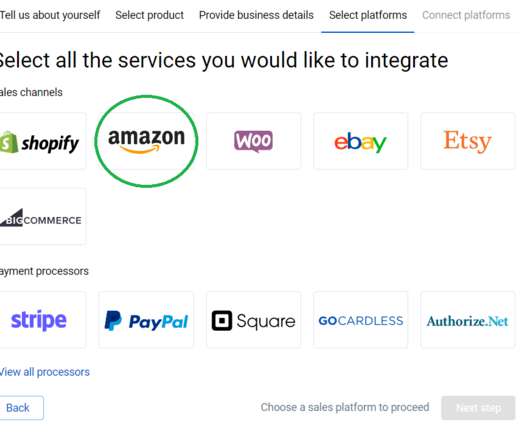

Let's personalize your content