Decisions 2024: The Opportunities for Accounting Firms Have Never Been Greater

CPA Practice

NOVEMBER 11, 2024

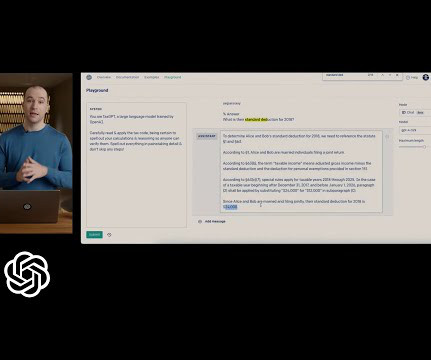

The Future Of Individual Tax Prep Is Brighter Than Ever While AI has been everywhere in the last few years, practical AI built into traditional platforms is being augmented by platforms to help with productivity. Sifting through what is in the market and coming to market, it is clear that tax preparation will be more profitable than ever.

Let's personalize your content