Year-End Bookkeeping and Accounting Checklist for Small Business Owners

xendoo

DECEMBER 3, 2021

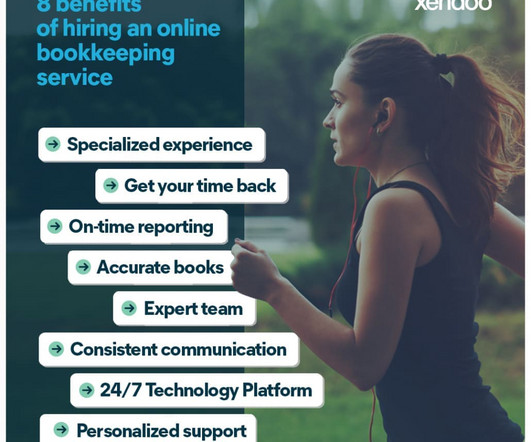

Between catching their breath after tax season and managing holiday traffic and sales, year-end bookkeeping and accounting tasks understandably fall to the bottom of the to-do list. . Our online bookkeepers provide catch up bookkeeping services , so you can focus on the future. . Xendoo is here to help.

Let's personalize your content