The Subtle Nuances of A/R in QuickBooks Online - A Complete Guide & Workshop

SchoolofBookkeeping

DECEMBER 15, 2024

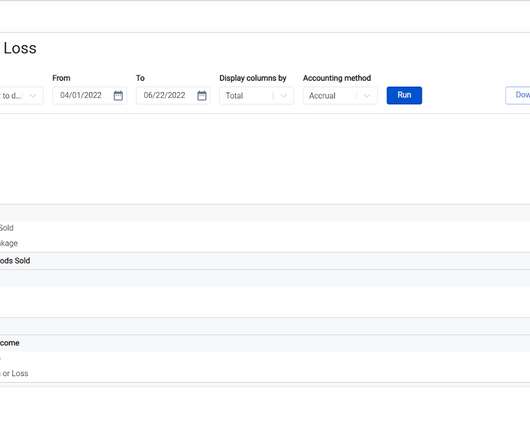

In this Workshop Wednesday, we dive into the intricacies of managing Accounts Receivable (AR) in QuickBooks Online (QBO) and QuickBooks Desktop, addressing common mistakes and offering practical solutions. This often stems from not following the prescribed QuickBooks workflows.

Let's personalize your content