How to File Income Tax Return: Tax Filing Preparation Guide 2022

Snyder

JUNE 9, 2022

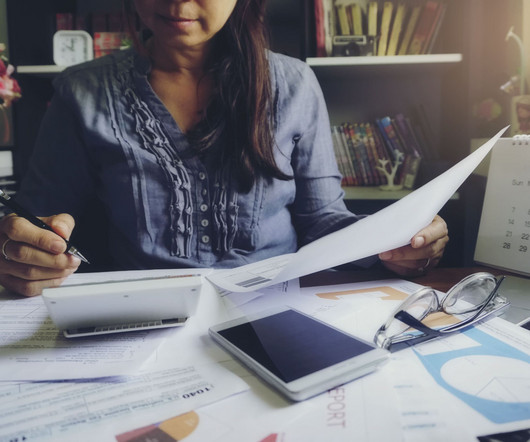

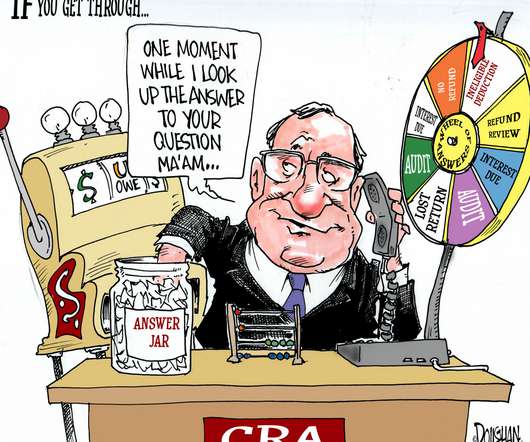

For e-commerce business owners, income tax filing season marks the start of a highly stressful time. Among the taxes that e-commerce businesses need to file, income tax is the most common one. What is income tax? How does income tax work? Who has to file income tax?

Let's personalize your content