Navigating the World of Bookkeeping for Marketing Agencies

Steve Feinberg

MAY 9, 2023

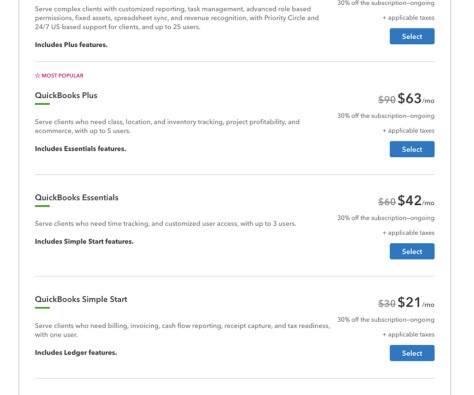

Every digital marketing agency should have a proper bookkeeping system in place to manage their preferred cash flow, whether that’s cash and accrual accounting, single-entry, or double-entry bookkeeping. Marketing agencies should choose their bookkeeping system based on their preference and accounting needs.

Let's personalize your content