What you need to know about quarterly updates for Making Tax Digital for Income Tax Self Assessment

Xero

JUNE 13, 2022

While here may not be the best place to ponder the ebb and flow of time, it is worth bearing in mind when assessing the April 2024 starting date for Making Tax Digital for Income Tax Self Assessment (MTD for ITSA). Affected taxpayers or their accountant or bookkeeper can submit quarterly updates for MTD for ITSA.

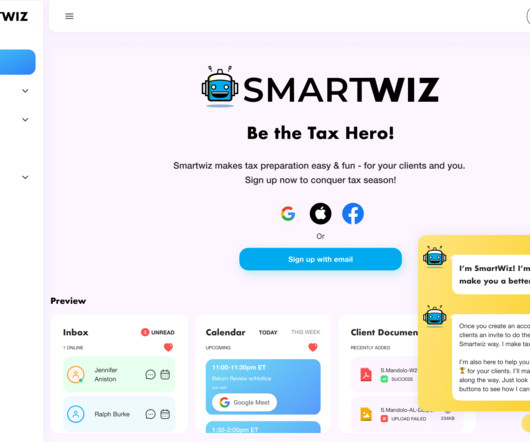

Let's personalize your content