Making the most of accounts payable automation

ThomsonReuters

APRIL 6, 2023

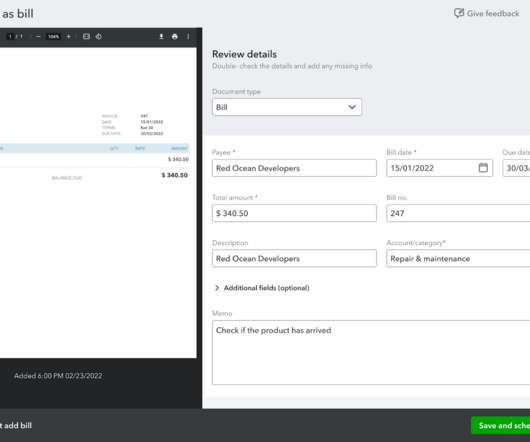

From eliminating manual processes to making timely payments to maintaining strong vendor relationships, a streamlined accounts payable process is crucial to the overall financial health of a business. But what should you look for in an accounts payable automation solution? Resolving the accounting records.

Let's personalize your content