Accounts Payable Automation Does More Than Just Issue Payments

AccountingDepartment

FEBRUARY 7, 2023

While accounting software has been around for decades, many businesses still rely on manual processes within their accounts payable (AP) operations.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

AccountingDepartment

FEBRUARY 7, 2023

While accounting software has been around for decades, many businesses still rely on manual processes within their accounts payable (AP) operations.

Ryan Lazanis

APRIL 4, 2022

Want all the information you need about accounts payable workflow automation? In this article, you’ll learn: What accounts payable automation is. 11 different benefits of automating this process. What is Accounts Payable Workflow Automation. 11 Benefits to Accounts Payable Workflow Automation.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Here's How To Fix Them

MineralTree

JANUARY 18, 2024

Optimizing the accounts payable (AP) process involves more than paying vendors on time — it’s also about maximizing efficiency and accuracy with every outgoing payment while managing cash flow to maintain a healthy business. The process includes invoice receipt, verification, approval, and eventual payment.

MineralTree

MARCH 16, 2023

We’ll also outline the benefits of partnering with a payment services provider and highlight how this third option enables teams to reap the most benefits for their AP workflow. The State of Accounts Payable Today Recession and inflation are top challenges for CFOs as they look to keep companies profitable in 2023.

MineralTree

OCTOBER 19, 2023

Accounts payable (AP) is a critical business function, responsible for protecting cash flow, maintaining good relationships with vendors, and ensuring compliance with financial regulations. It’s no surprise that MineralTree’s State of AP Report identified the AP function as the No.

MineralTree

AUGUST 10, 2023

But a key component of cash flow balance — accounts payable — is often overlooked. Accounts payable (AP) is inherently tied to a business’ financial stability. Let’s review the role of accounts payable on cash flow and dive into best practices for optimizing cash flow.

CPA Practice

MAY 22, 2024

Goldman Sachs recently estimated that automating Accounts Payable processes can result in time savings of 70-80% for small and medium-sized businesses. Efficient accounts payable (AP) processes are crucial for maintaining a healthy cash flow and fostering strong relationships with suppliers.

MineralTree

JUNE 1, 2023

Managing accounts payable can be a time-consuming and challenging task, especially for businesses with limited resources. Thankfully, the right accounts payable software can help businesses streamline their payment processes, reduce manual errors, and improve efficiency.

Airbase

NOVEMBER 15, 2023

Accounts payable (AP) refers to the series of steps that companies take to pay their bills. It requires the safe handling and recording of funds transferring from the company’s bank account to suppliers and vendors. Table of Contents FirstHeading What is AP automation? Using AP automation software.

PYMNTS

SEPTEMBER 26, 2018

With adoption rates now rising, accounts payable (AP) departments have improved their positions within the enterprise as strategic functions, with the potential to offer greater insight into company operations. less to process a single invoice. less to process a single invoice. days faster for best-in-class firms.

MineralTree

FEBRUARY 1, 2024

The focus was on assessing the current digital payments landscape and end-to-end AP automation to better understand key trends, challenges, and priorities for AP teams. The survey sheds light on the pivotal role that AP automation plays in driving efficiency, which we’ll take a deeper dive into in this blog.

Airbase

NOVEMBER 29, 2023

Implementing accounts payable best practices can help your organization reduce risk, save time and money, foster strong vendor relationships, and create a better spend culture. You can better identify the best AP automation solution for your organization by following accounts payable best practices.

PYMNTS

NOVEMBER 15, 2018

A new report from Software-as-a-Service (SaaS) firm Inspyrus suggested that chief executive officers and accounts payable (AP) professionals aren’t seeing eye to eye on AP technology, and organizations are failing to upgrade their AP processes and tools as a result.

MineralTree

AUGUST 24, 2023

Are you relying on the current accounts payable (AP) workflow in QuickBooks Desktop or Online to manage your financial operations? The QuickBooks AP workflow includes tasks like invoice receipt, data entry, approval, and payment required to manage AP within the software. If so, you’re not alone.

MineralTree

JANUARY 25, 2024

This blog takes a deeper dive into 7 accounts payable trends that will help shape 2024. AP automation remains a top priority because it provides substantial operational efficiencies and helps teams track payment flows and gain control over payment transaction timing.

PYMNTS

DECEMBER 3, 2020

Intelligent automation supplier Kofax has announced new innovations for its invoice and accounts payable (AP) solutions, according to a press release. The new solutions will go further toward transforming AP processes with automation.

PYMNTS

APRIL 14, 2020

Legacy accounts receivable (AR) and accounts payable (AP) operations aren’t only inefficient, they’re costly. PYMNTS’ latest The Optimizing AP and AR Playbook , a collaboration with OnPay Solutions, found that businesses in the U.S.

PYMNTS

DECEMBER 31, 2019

Manual processes can be particularly problematic for such businesses because these firms can generate thousands of payments every day. The following Deep Dive further explores how paper-based methods can result in processing delays and how new, cutting-edge payment innovations can drive accounts payable (AP) automation.

PYMNTS

JUNE 12, 2019

In an interview with Doug Cranston, vice president of product management at Bottomline, the executive noted that in the age of speed, fraudsters are able to more easily exploit firms’ vulnerabilities, compromise their accounts payable process and get away with ill-gotten gains, often to vanish without a trace.

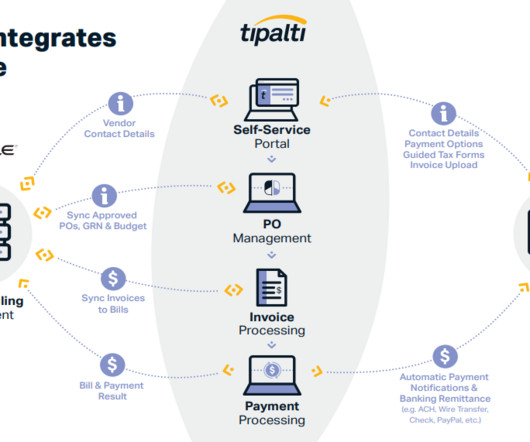

AccountingDepartment

JUNE 8, 2023

Imagine having the ability to scale accounts payables (AP) operations for your e-commerce business, with the same amount of staff, or even less. With Tipalti's AP automation technology, businesses can do just that and accelerate their AP processes across the board.

PYMNTS

AUGUST 28, 2019

Accounts payable automation company AvidXchange is strengthening its position in the banking and financial services sector through the acquisition of BankTEL, the company said Tuesday (Aug. AvidXchange has reached an agreement to acquire BankTEL Systems, which provides accounting technology to banks.

PYMNTS

JANUARY 29, 2019

Straight-through processing (STP) is the gold standard for accounts payable (AP) departments. For businesses that do experience a high volume of exceptions, the AP department can remain a manual area of the enterprise, even with technological adoptions.

Accounting Insight

JANUARY 20, 2025

For instance, a renowned Savile Row tailor struggled with inefficiencies in their accounts payable (AP) process when relying on manual systems. Modernising finance to safeguard legacies To overcome the challenges of outdated finance practices, traditional organisations must focus on modernising their AP processes.

Accounting Insight

OCTOBER 18, 2022

CFOs wear many hats and are well-positioned to help to head off costly supply chain disruptions, with the support of their Supply Chain Manager, a profession which has historically faced challenges when it comes to Accounts Payable (AP) processes. appeared first on Accounting Insight News. billion by 2026.

MineralTree

MARCH 14, 2024

However, many companies still rely on manual processes to manage accounts payable—and these outdated practices are causing problems across their financial operations. A manual approach slows down the payment process and increases the risk of errors and fraud while jeopardizing relationships with strategic vendors.

PYMNTS

DECEMBER 17, 2018

The company said its Kodak Services for Business will include invoice automation as the company pushes for further accounts payable (AP) automation capability. Automation is on the rise in accounts payable, as AP professionals seek ways to reduce manual processes and instead focus on more strategic initiatives.

Accounting Insight

NOVEMBER 29, 2022

Accounts payable automation, also known as AP automation or invoicing automation, is the process of automating accounts payable processes and activities while collecting the critical data required to make smart decisions, improve efficiency, and grow your business. As real-time?

PYMNTS

OCTOBER 6, 2020

The pandemic has upended supply chains, and upended accounts payable (AP) processes – requiring companies of all sizes and types to move toward digital (and high-tech-powered) means to transform back-office functions. And for that, the AP process has to be smooth.

CPA Practice

DECEMBER 20, 2023

Xero integrates with Quadient’s Accounts Payable (AP) capabilities to fully automate and streamline accounting processes. million subscribers worldwide to run their business accounting online and in one place. Xero helps 3.95

PYMNTS

DECEMBER 28, 2020

Nacha is issuing a warning to accounts payable professionals with regards to the rising threat of fraud. Further, Nacha said, the survey revealed AP professionals are facing increasing fraud attempts that target AP processes specifically.

CPA Practice

DECEMBER 17, 2023

Accounts Payable (AP), in particular, has become ground zero as liquidity and cash flow become even more indispensable. 52% of AP teams plan to adopt or invest more in automation this year, seeing the opportunity to increase productivity, better manage cash flow and reduce risk, among other benefits.

PYMNTS

MAY 2, 2019

Innovation for accounts payable is often an afterthought, but automated solutions can efficiently onboard customers, cut back on errors and eliminate paper-based invoicing systems. percent: Share of firms with “very” or “extremely” efficient AP processes that were interested in innovation.

PYMNTS

MARCH 31, 2020

To make the complete payables process smarter, global payables automation company Tipalti unveiled its Tipalti Pi integrated payables intelligence engine, according to a press release.

MineralTree

DECEMBER 1, 2022

The good news is that there are several ways your business can reduce overdue payments in your accounts payable department, and it starts with AP automation. This information can be used to make changes to your processes or policies to reduce overdue payments. Set Payment Dates in an AP Tool. In fact, 46.1%

MineralTree

NOVEMBER 17, 2022

While savvy retailers promptly responded to changing customer behavior with new digital technology initiatives, other retailers still struggle with supply chain issues, accounts payable inefficiencies, and high costs, without enough staff to help. Why Now for AP in Retail. Manual AP Processes Continue to Drop the Ball.

PYMNTS

APRIL 17, 2020

Smooth accounts payable (AP) processes are critical in the spice business, in which purveyors must send funds securely to vast numbers of distributors and growers worldwide. … We don’t write it down even, [but] it’s all in our accounts payable [system],”.

PYMNTS

FEBRUARY 14, 2019

Cloud-based accounts payable solution provider Esker is teaming up with document services unit Fuji Xerox to deploy accounts payable solutions across the Asia Pacific region, the companies announced on Wednesday (Feb. Moving forward the firms will expand the offering to Australia, Hong Kong and Singapore.

MineralTree

OCTOBER 26, 2023

Automation is reshaping the way companies manage their financial operations, especially in accounts payable (AP). Understanding how AP automation works and how it streamlines AP processes is vital to keeping your company ahead of the curve in a rapidly evolving business finance landscape.

PYMNTS

DECEMBER 13, 2020

This is a huge step in our mission to simplify [accounts payable (AP)] payments for Microsoft technology users and to successfully support our shared customer and partner base," Rolfson said, according to the release.

PYMNTS

APRIL 9, 2020

To help additional middle-market companies automate their accounts payable (AP) processes, MineralTree announced that it has grown its integration abilities, according to a press release. In separate news, OpenText unveiled its new Trading Grid with a rollout that connects ERP with AP, among other systems.

MineralTree

DECEMBER 22, 2022

What does digital transformation mean in Accounts Payable? Digital transformation in Accounts Payable (AP) occurs when teams use technology to automate and streamline manual processes across the back office. Accounts payable teams can facilitate various electronic payment methods and checks via one system.

PYMNTS

MAY 1, 2019

Accounts payable operations are essential to ensuring that payments to a firm’s partners and suppliers are processed and delivered on time. These processes prevent companies from missing payments and running the risk of souring business relationships and hurting their partners’ bottom lines in the process.

PYMNTS

DECEMBER 16, 2020

Tipalti Enhances Corporate Card Adoption In AP. Accounts payable (AP) solution provider Tipalti is looking to drive commercial card adoption in B2B payments, even with vendors that don't accept cards. Paynetics, Unionpay International Collaborate For Business Cards.

CPA Practice

MARCH 27, 2023

One of the areas that can benefit most from automation is accounts payable (AP). And even if finance leaders can bring more AP professionals on board, it may not be enough to address the inherent inefficiencies and problems of manual processing.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content