Your Bottom Line Is Taking The Hit. Is It Poorly Managed Accounts Payable?

GrowthForceBlog

AUGUST 9, 2021

You know by now that accounts payable is more than just “paying the bills”. 6 min read.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

GrowthForceBlog

AUGUST 9, 2021

You know by now that accounts payable is more than just “paying the bills”. 6 min read.

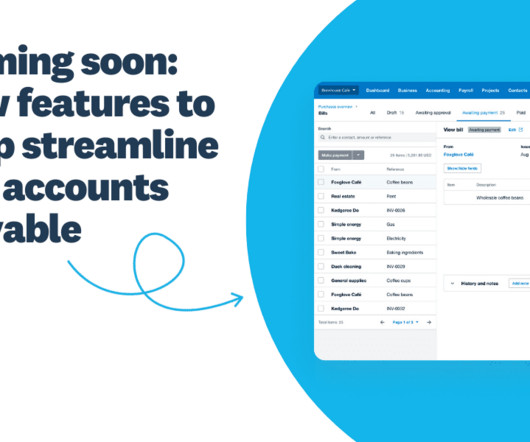

Xero

AUGUST 8, 2024

Managing accounts payable is a crucial part of doing business, but paying the bills can be time-consuming and inefficient. We’re excited to announce that, over the next few months, we’re making some enhancements to the way you manage bills in Xero. So we’re on a mission to make it easier.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Next-Level Fraud Prevention: Strategies for Today’s Threat Landscape

Outsourcing Vs. In-House: The Ultimate Battle For Better Collections

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

The Silent Crisis: Why Finance Lags in Digital Transformation and How to Accelerate AI Adoption

Basis 365

NOVEMBER 30, 2023

One critical aspect is the management of accounts payable (AP). Effective accounts payable strategies not only streamline the payment process but also contribute significantly to better cash flow management. Automation for Accuracy and Efficiency In this fast-paced business world, time is money.

Next-Level Fraud Prevention: Strategies for Today’s Threat Landscape

Outsourcing Vs. In-House: The Ultimate Battle For Better Collections

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

The Silent Crisis: Why Finance Lags in Digital Transformation and How to Accelerate AI Adoption

DuctTapeMarketing

JULY 14, 2018

According to US Bank, 82% of businesses that fail, are actually profitable but failed to manage their cash flow. Handle payments and manage accounts payable. This task helps you avoid running out of money suddenly — leaving you unable to pay employees, vendors, or Uncle Sam.

MineralTree

NOVEMBER 2, 2023

Accounts payable is a foundational function that ensures organizations maintain accurate invoices, payments, and vendor relationships, while making bill payments on time. However, amidst today’s rapid and intricate business transactions, particularly in high volumes, managing accounts payable processes can pose significant challenges.

MineralTree

JUNE 1, 2023

Managing accounts payable can be a time-consuming and challenging task, especially for businesses with limited resources. Thankfully, the right accounts payable software can help businesses streamline their payment processes, reduce manual errors, and improve efficiency.

AccountingDepartment

MAY 16, 2024

These services involve outsourcing the accounting and bookkeeping tasks to a third-party service provider, allowing businesses to focus on their core operations.

AccountingDepartment

DECEMBER 21, 2023

These services involve outsourcing the accounting and bookkeeping tasks to a third-party service provider, allowing businesses to focus on their core operations.

ThomsonReuters

APRIL 6, 2023

Accounts payable (AP) is an important signal in understanding the financial health of a business. By optimizing your accounts payable workflow, you can gain insight into cash flow, make better business decisions, and ensure strong relationships with vendors and suppliers.

SchoolofBookkeeping

JANUARY 30, 2025

Intuit claims to have been tuning into their customers' woes, particularly those grappling with the cumbersome task of managing accounts payable. These updates are supposedly designed to alleviate the pain points experienced by users, making the accounts payable process more seamless.

MineralTree

MARCH 14, 2024

However, many companies still rely on manual processes to manage accounts payable—and these outdated practices are causing problems across their financial operations. An overview of high-volume accounts payable High-volume AP involves managing a large number of invoices and payments. Did you know?

Accounting Insight

NOVEMBER 29, 2022

Accounts payable automation, also known as AP automation or invoicing automation, is the process of automating accounts payable processes and activities while collecting the critical data required to make smart decisions, improve efficiency, and grow your business. As real-time? REDUCING PAPER AND INCREASING SECURITY.

ThomsonReuters

APRIL 6, 2023

Whether you’re an accountant, a small business owner, or a professional working within an organization, understanding what accounts payable is and how it works is essential. As an important cash flow indicator, accounts payable is a sign of the health of a business. Often, these types of charges are invoiced.

Withum

SEPTEMBER 6, 2022

What used to be a process managed through a single credit card and bank account, which were reconciled with minimal time and resources, has now become an overwhelming monthly task. These tasks are frequently managed by a process owner who wears many hats. Centralized Accounting.

Lockstep

MAY 19, 2022

Designed for individuals and teams, Lockstep Inbox provides an online workspace that lets accounting join the automation revolution quickly and easily. For developers, Lockstep API is the easy, modern platform for building fintech applications that work with their customers’ accounting systems.

CPA Practice

AUGUST 26, 2024

Embracing Automation The platforms and solutions that are quickly becoming table stakes for accounting firms often offer automation tools that can be applied to optimize sometimes-tedious processes and workflows.

CPA Practice

SEPTEMBER 13, 2023

Randstad found that the most in-demand jobs in accounting and finance for 2024 are: accounts payable/accounts receivable clerk, accounting manager, controller, financial analyst, and staff accountant.

PYMNTS

NOVEMBER 10, 2020

AP Optimizer has the effect of putting those services into a single system and lets organizations work on cutting costs, creating rebate opportunities and better managing working capital, the release stated. “AP Bank, according to the release.

Lockstep

JANUARY 4, 2023

If you manage accounts receivable (AR) and accounts payable (AP) for your business, you know how important it is to have a system in place to keep track of all incoming and outgoing payments. A shared accounting inbox can be a great way to do this, as it allows both AR and AP managers to see all payments in one place.

CPA Practice

FEBRUARY 13, 2023

It’s essential for companies to effectively manage their inventory costs and control the manufacturing process. Lean accounting: This is a management accounting approach that aligns with the principles of Lean manufacturing, including reducing waste and maximizing value.

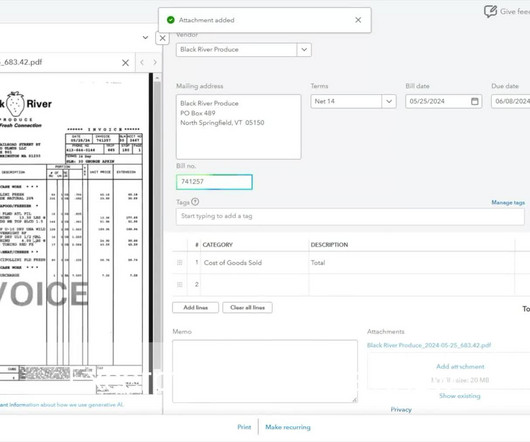

Insightful Accountant

JULY 8, 2024

Many accounting professionals struggle with the time-consuming and error-prone task of managing accounts payable (AP). If you missed our recent App Academy , MakersHub presented how their innovative solution can revolutionize this critical process.

PYMNTS

NOVEMBER 21, 2018

With pressure mounting for the enterprise to digitize, accounts payable automation is seen as a crucial part of achieving greater efficiency, cost savings, visibility into spend and strengthening of vendor relationships, to name a few benefits. But when it comes to money, businesses may be reluctant to hand the reins to a third party.

Lockstep

DECEMBER 2, 2022

By using dedicated email accounts for accounts receivable (AR) and accounts payable (AP), businesses can avoid some of the common pitfalls that come with a lack of organization. In this blog post, we will discuss the benefits of using shared accounting inboxes and how they can help your business grow.

Basis 365

DECEMBER 18, 2023

Manage Working Capital Changes: Track the change in your current assets and liabilities (inventory, accounts receivable, accounts payable) between two periods. You also had $2,000 of depreciation and an increase in accounts payable of $1,500. Factor this change into your calculations.

Basis 365

FEBRUARY 1, 2023

Accountant Vs. Controller Controllers and accountants often share the same responsibilities and roles. A controller, however, is the more senior position responsible for managing accounting-related activities within the company. Candidates must hold a CPA license to be eligible for higher-ranking accountant positions.

PYMNTS

JUNE 12, 2020

For businesses that continue to rely on paper and checks to manage accounts payable (AP) workflows, the reality is that working from home cannot support the legacy ways of paying vendors and managing spend.

MineralTree

OCTOBER 26, 2023

Automation is reshaping the way companies manage their financial operations, especially in accounts payable (AP). What is Accounts Payable Technology and What is its Role? In essence, AP technology enables businesses to efficiently handle the process of paying their bills and managing their outstanding liabilities.

PANALITIX

JANUARY 5, 2021

The CFO should have laser-like focus on how improved inventory management, accounts receivable and accounts payable affects the business. They recommended additional promotions and sales activity to drive revenue in this niche area. How can we strengthen the Balance Sheet?

Lockstep

FEBRUARY 28, 2023

Enjoy a secure and collaborative inbox that integrates perfectly with QuickBooks Online to bring your accounting process to life. No more dropped threads or vague paper trails; with Lockstep Inbox you can easily manage account activity workflows in real time so you never miss an update or skip a beat.

Basis 365

JULY 18, 2024

Managing Accounts Receivable and Payable: Tracking money owed to the business (accounts receivable) and money the business owes to others (accounts payable), ensuring timely payments and collections. Paying Bills: Managing accounts payable and ensuring that bills are paid on time.

PYMNTS

OCTOBER 18, 2016

In B2B payments, the paper check is an especially persistent problem that can yield inefficiencies both on the accounts payable and accounts receivable ends. Meanwhile, in B2B payments, the use of the paper check is actually on the rise within the accounts payable department. to process a single paper check.

Accounting Insight

SEPTEMBER 4, 2024

We’re an all-in-one platform designed to help you manage Accounts Payable, Accounts Receivable, and Cash Flow all in one place. For accounting firms, this means you can save time and money by consolidating your tools, while also offering strategic services to your clients. Mimo stands for Money-in & -out.

inDinero Accounting

DECEMBER 13, 2021

Beyond that, most accounting softwares offer many additional features including, but not limited to, payroll, tax filing, and inventory tracking. Accounting softwares may also feature options for payment processing on the accounts receivable side and vendor payment functionality on the accounts payable side.

Anders CPA

FEBRUARY 5, 2024

With a background in both audit and controllership, he has insight and perspective in finance that takes the full picture into account. In his role as an assistant controller, David manages accounts payable and receivable in addition to in-depth financial reporting.

Basis 365

OCTOBER 19, 2022

As the customer base grows, so will the need for precise financial accounting. A solid system for managing accounts will help to strengthen the monetary base, which will be the foundation of the company's advancement. These factors are essential to managing accounts payable (A/R).

PYMNTS

JANUARY 22, 2020

The inventory of solutions includes corporate travel and entertainment cards in addition to a B2B virtual card that enables corporates to manage accounts payable with more control.

PYMNTS

JUNE 25, 2018

Reactive instead of proactive planning, late payments, a lack of visibility: Accounts payable professionals in the U.K. Accounts payable automation firm Invu released its latest survey, “ Changing trends in the purchasing processes of U.K.

Basis 365

AUGUST 21, 2024

Practical Application: Outsourcing: Partner with a fractional accounting department company to include more team members into the segregation of duties workflow. Accounts Payable: Use tools like BILL Payables & Receivables to automate the workflow between team members.

CPA Practice

MARCH 26, 2024

Randstad found that the most in-demand jobs in accounting and finance for 2024 are: accounts payable/accounts receivable clerk, accounting manager, controller, financial analyst, and staff accountant.

PYMNTS

NOVEMBER 13, 2019

In the drive to manage accounts payable (AP) more efficiently, buyers can not only optimize their own working capital, they can help suppliers, too. With a nod to the partnership model, the Bottomline Technologies VP said FinTechs have helped drive the evolution of accounts payable automation.

PYMNTS

DECEMBER 9, 2019

5) that it is integrating AvidPay into its BankTEL product suite, which is designed for financial institutions (FIs) to manage accounting and expenses. The integration means banking customers will gain access to the AvidPay network for streamlined accounts payable (AP). The company announced on Thursday (Dec.

MyIRSRelief

MARCH 15, 2023

Professional accountants can help trucking companies manage their cash flow effectively by monitoring accounts receivable and accounts payable. In addition to managing accounts receivable and accounts payable, professional bookkeepers can also help trucking companies develop a cash flow forecast.

PYMNTS

JANUARY 10, 2020

Plus, said Jandrell, these firms increasingly require the capability to manage processes before and after purchases are made. Historically, that has meant disparate, siloed platforms for expense management, contract management, accounts payable automation and more.

PYMNTS

DECEMBER 5, 2019

After all, money exits a company through more than one avenue, whether it be via the accounts payable department or a firm’s own employees. Understanding businesses’ biggest payment pain points requires a wide line of sight.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content