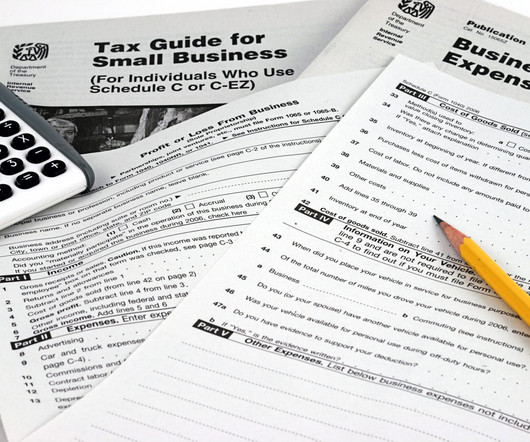

Cash or Accrual Accounting: What’s Best for Tax Purposes?

RogerRossmeisl

SEPTEMBER 9, 2024

Your businesses may have a choice between using the cash or accrual method of accounting for tax purposes. The cash method often provides significant tax benefits for those that qualify. However, some businesses may be better off using the accrual method. appeared first on Roger Rossmeisl, CPA.

Let's personalize your content