The Benefits of Outsourcing Bookkeeping for Small Business Growth

MyIRSRelief

DECEMBER 2, 2024

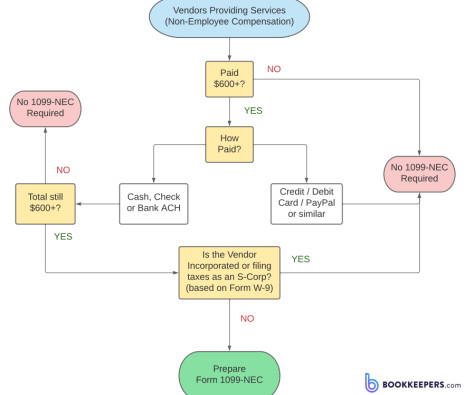

Accurate Financial Records : Professional bookkeepers are skilled at managing financial transactions, ensuring accuracy, and reducing errors. This expertise can be especially valuable during tax season or audits, where precision is critical. This level of review can be challenging for small businesses managing bookkeeping internally.

Let's personalize your content