Why Am I Being Audited and How Does the IRS Conduct Them?

RogerRossmeisl

OCTOBER 13, 2024

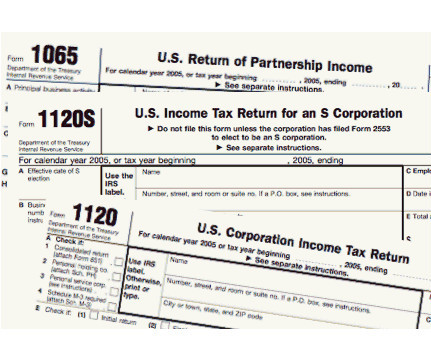

As appearing at the IRS web page entitled “IRS Audits” An IRS audit is a review/examination of an organization’s or individual’s books, accounts and financial records to ensure information reported on their tax return is reported correctly according to the tax laws and to verify the reported amount of tax is correct.

Let's personalize your content