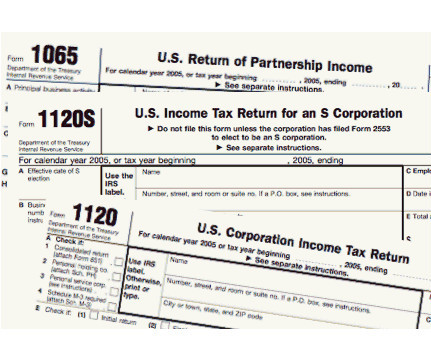

S Corporations: Tax Preparation, Tax Planning, and the Benefits of Professional Tax Help

MyIRSRelief

NOVEMBER 1, 2024

S Corporations: Tax Preparation, Tax Planning, and the Benefits of Professional Tax Help S Corporations , often referred to as S Corps, are a popular business structure in the United States, particularly among small to medium-sized businesses. However, navigating the tax landscape for S Corps can be complex.

Let's personalize your content