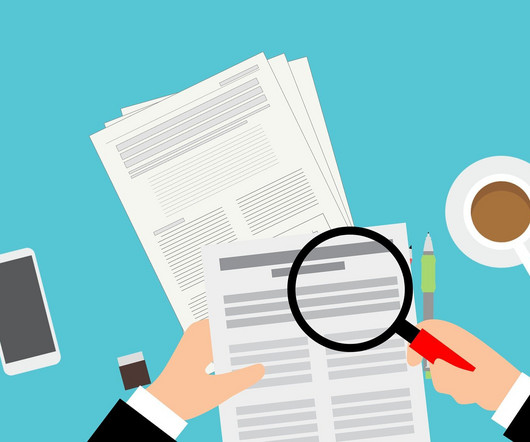

How Your Business Can Prepare For and Respond to an IRS Audit

RogerRossmeisl

OCTOBER 20, 2024

The IRS has been increasing its audit efforts, focusing on large businesses and high-income individuals. By 2026, it plans to nearly triple its audit rates for large corporations with assets exceeding $250 million. Under these plans, partnerships with assets over $10 million will also see audit rates increase tenfold by 2026.

Let's personalize your content