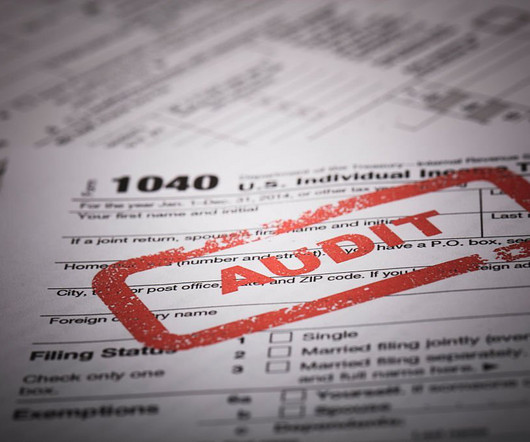

Top Tips to Prepare for an eCommerce Audit

TaxConnex

NOVEMBER 29, 2022

that the likelihood of your business being audited is low, but that likelihood has been increasing in recent years. more than one in four (26.7%) top finance professionals reported seeing an increase in state sales tax audits in the past two years. Without sales tax nexus, you have no obligation to collect or remit sales tax.).

Let's personalize your content