Employment outlook for 2025

TaxConnex

JANUARY 16, 2025

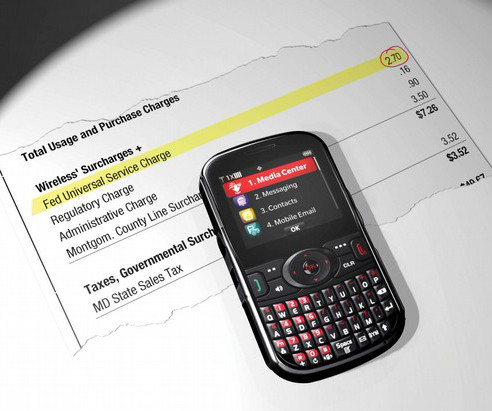

More than a third of respondents (35%) added that the major reason theyre unsatisfied with how they handle sales tax is lack of internal expertise (their biggest subsequent worry: lack of preparedness for a sales tax audit). Many accountants leave public accounting for a better work-life balance.

Let's personalize your content