How to Package Your Bookkeeping Services [Guide]

Ryan Lazanis

OCTOBER 6, 2022

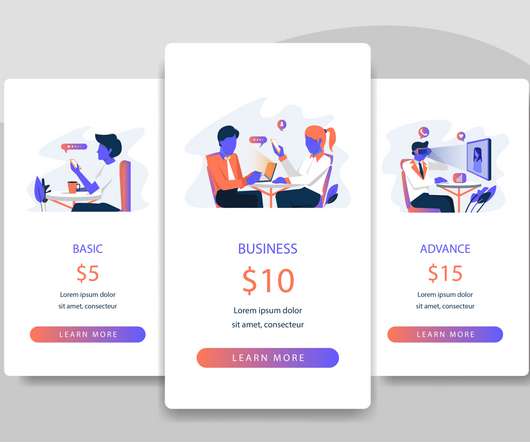

In this guide, I’ll describe how to package bookkeeping services in a way that’s highly profitable but also very appealing for your clients. What Does Packaging Your Bookkeeping Services Mean? Why Does Packaging Your Bookkeeping Services Matter? What Bookkeeping Services Can Be Packaged?

Let's personalize your content