What Accountants Had to Say About the CPA Firm Business Model—and Why it Needs to Evolve

CPA Practice

AUGUST 31, 2023

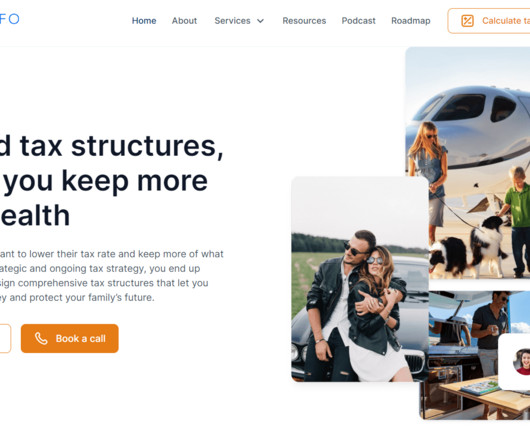

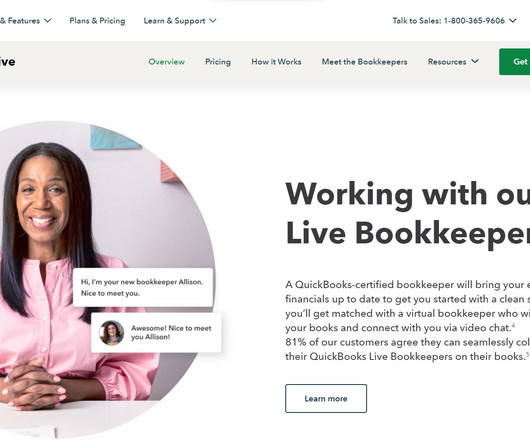

So I went on Google,” said Moore, an enrolled agent who owns Duke Tax, a business that provides tax and bookkeeping services to entrepreneurs and content creators. At firms like Deloitte, you have to do things a certain way,” he said. “A Duke Alexander Moore “I didn’t want to embarrass myself when I’m up here. by revenue.

Let's personalize your content