The Benefits of Outsourcing Bookkeeping for Small Business Growth

MyIRSRelief

DECEMBER 2, 2024

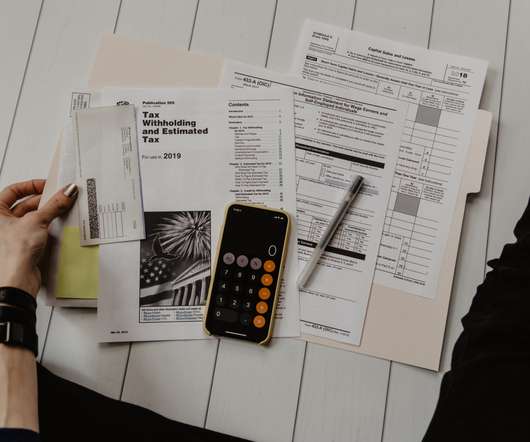

The Benefits of Outsourcing Bookkeeping for Small Business Growth Outsourcing bookkeeping has become a game-changer for small businesses looking to streamline operations, cut costs, and focus more on growth. Up-to-Date Knowledge of Financial Regulations : Tax laws, payroll regulations, and other financial rules are constantly changing.

Let's personalize your content